News

DBS, OCBC and UOB join unified QR Code platform

DBS, OCBC and UOB join unified QR Code platform

The platform will be able to accept payments from customers using the various banks’ payment apps.

3 in 4 employees blame their firms for bad customer service

They blame time-consuming controls and limited budget.

8 in 10 employees upgrade their skills on their own

About 45% sign up for curriculum courses.

OCBC acquires National Australian Bank's private wealth business in Hong Kong

The move seeks to boost the bank’s mortgage and deposit books.

Noble to sell US-based ethanol producer

The base asking price is at $16.83m.

IT workers could earn up to 15% more in 2018

They can expect annual salaries of between $180,000 and $450,000.

Daily Markets Briefing: STI up 0.55%

Expect some moderate gains today.

Daily Briefing: How to choose a DBS home loan; HR workers expect to earn $400,000 a year

And here are five things you need to know about Cromwell European Real Estate Investment Trust's IPO.

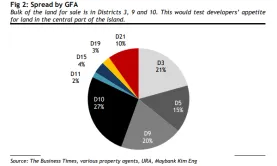

Chart of the Day: Bulk of land supply lies in central districts

About 27% are in district 10.

Wilmar establishes eight subsidiaries

They were formed in Singapore, South Africa, and Tanzania.

Bankers' salaries could rise by up to 5%

But expect hiring levels to slow down as the firms integrate IT into their systems.

Netflix and kill: Telcos' Pay TV subscriber base down 4% to 871,000

Users are switching over to over-the-top content providers.

MAS tightens Abu Dhabi ties on bank supervision

It will work with a regulator to monitor fintech activities.

CapitaLand to go cashless in China

The four million members of its rewards programme can pay through a mobile app.

DBS beats Singtel as Southeast Asia's largest company by market cap

DBS is now valued at $62.97b.

Singapore's manufacturing output rose 14.6% in October

The electronics cluster led the growth with a 45.1% expansion.

Oxley Holdings could bag $2.3b from overseas contracts

Contracts will be progressively recognised in the UK, Cambodia, and Indonesia.

Advertise

Advertise

Commentary

Singapore’s family offices: Time to professionalise or risk falling behind

Liquidity crucial to stock market reform