News

Singapore's largest bus maker to build $30m facility in Myanmar

Singapore's largest bus maker to build $30m facility in Myanmar

Production in the 16,000-sqm facility will begin in Q4 2018.

DBS outshines rivals in terms of pre-provision operating profit

It registered the highest PPoP growth with an 8% CAGR.

Condo resale prices up 0.4% in May

Only condos outside the central region reported a decline in resale prices.

CapitaLand Commercial Trust withdraws issuance of bonds

The $21.75m of the aggregate bonds have been converted by holders.

SPH's media earnings to be 5% weaker this year

It is unlikely to bottom in the near term.

PropNex-DWG merger forms Singapore's largest real estate player

Combined network of salespersons reaches nearly 7,000.

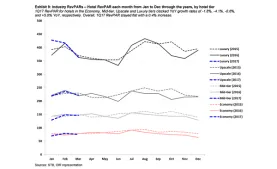

Chart of the Day: Luxury hotels record the only positive RevPAR growth in Q1

It grew 5% compared to last year.

Daily Markets Briefing: STI down 0.18%

The weakness on Wall Street could weigh on the local market today.

Daily Briefing: Singapore offers a helping hand to China; Why SIA remains attractive for investors

And is it more expensive to own a car than use ride-hailing apps?

Domestic players still hold majority of residential market

They account for 79% of the market share.

Chart of the Day: Household spending to jump 44.7% in 2021

It will grow at an average rate of 8.3%.

Daily Briefing: Brick-and-mortar retailers still eye setting up in Singapore; District 4 sees pickup in transactions

And check out these four charts about Singapore's economy.

Daily Markets Briefing: STI up 0.53%

Wall Street's mixed performances won't provide much cues for the local market.

GLP bidders urged to submit proposals

Deadline for the proposals is on June 30. Shortlisted bidders for Global Logistic Properties will have to submit their proposals on or before June 30. The group formed a Special Committee that will thoroughly evaluate the proposals in consultation with the Company’s external advisers. "The Company reiterates that no binding proposals have been received to date, and wishes to emphasize that any firm proposals, if and when received, may remain non-binding, may be subject to relevant regulatory approvals or other conditions and may not be offers that are capable of acceptance," the group said. It added, "There is no certainty that any proposals will be received or that any definitive transaction will materialize from, or any offer will be made as a result of, any proposals received or the Strategic Review, and there also remains no certainty as to the terms of a transaction (if any). The Company will make an appropriate announcement in the event of any material developments."

Landlords' yields on self storage facilities to hit 7%

Small living spaces in Singapore drive demand for self storage. Across Asia, self storage facilities are attracting investor interest due to its growth potential. According to a report by real estate consultancy firm JLL, landlords can expect yields of around two to four per cent in Hong Kong and Taiwan, five to seven per cent in Tokyo and Singapore, five to eight per cent for Australia, and up to eight per cent or above in China and India depending on location, access, quality, and building facilities. The self-storage sector is expected to take off as the notion of storing personal items outside the home is catching on due to the region’s dense population, increasing residential prices, growing affluence, and changing lifestyles. In Singapore, rising income and small living space drive demand for self storage. Average home sizes are at 77sqm whilst GDP is at US$51,718 per capita. “Globally, demand for self-storage, just like any other real estate class, is driven by economic and demographic forces,” says Bob Tan, Director of Alternatives, Asia Pacific Capital Markets at JLL. “Urbanisation is an important driver for self-storage. Growing urban populations mean smaller and increasingly expensive living spaces in cities, and creation of more renters who move around more frequently." For businesses, self storage also provides a flexible alternative with its relatively manageable leases and appropriately-sized space from a self storage provider instead of a large warehouse where much of the space may go unused. Businesses that use self storage space include large companies (for archival and document storage) as well as SMEs and start-ups that use them to store and sometimes even display merchandise. Here’s more from the JLL report:

Here's why StarHub lacks growth catalysts

The mobile outlook remains weak as competition intensifies. Whilst StarHub's recent acquisition of stakes in a cybersecurity firm makes sense, OCBC Investment Research believes it will still take time to build up its cyber security capabilities before it gains significant traction. More so, it noted that StarHub's medium term outlook is expected to be slow. OCBC outlines three reasons why the telco lacks catalysts. For one, the group's overall mobile outlook remains weak due to the intensifying competition with other telcos. Secondly, StarHub's PayTV woes are seen to persist, given the pressure from over-the-top (OTT) services and piracy, Lastly, the competition in broadband segment is set to increase as TPG enters the market.

3 key areas affluent households will spend on

These will account for almost 40% of their spending by 2021. Singapore's affluent middle class supports high spending on non-essential goods and services such as personal, insurance & other, recreation and culture, and restaurants and hotels, according to BMI Research. Here’s more from BMI Research:

Advertise

Advertise

Commentary

Singapore’s family offices: Time to professionalise or risk falling behind

Liquidity crucial to stock market reform