News

Freehold property at Haig Road sold at $49.3m via collective sale

Freehold property at Haig Road sold at $49.3m via collective sale

The 173-178 Haig Road (Odd Nos.) is composed of 24 units.

Unemployment rates back to pre-COVID levels: MoM

The overall rate fell to 2.1% in February.

After campaign, CapitaLand malls eCapitaVoucher sales grow by 135%

The “Spend and Win Big” campaign also generated 5.7 million views on CapitaStar app.

SATS invests $150m for hub on food production automation

The construction of the food hub is expected to be completed in 2024.

MAS transfers S$75b excess Official Foreign Reserves to government

This brings the stock OFR to around 95% of Singapore’s GDP.

Market Update: STI down at 0.55%

Sembcorp Industries dominated the index.

Singapore Maritime Foundation is first partner of UN maritime transition task force

The foundation will contribute to the task force’s first project in maritime.

CapitaLand Investment to issue notes valued at $400m under Euro programme

The fixed rate senior notes are due in 2027 with 3.33% interest per annum.

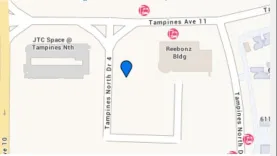

JTC launches tender for site at Tampines North Drive

The land parcel had a committed bid price of over $7m.

Prime logistics properties up by 3% in Q1 2022

Except for outlying business park space, steady rental increases were seen.

HDB resale volume soars 19.2% QoQ in March

Analysts attributed the increase to the easing of safe management measures.

Will a looming recession in the US shake S-REITs?

The US yield curve—an indicator of recession—has been inverted since 1 April.

Maritime Week: MPA, IMO launch NextGEN Connect

Through the platform, stakeholders can jointly develop solutions for maritime decarbonisation.

CBD Grade A office rents climb 2.1% QoQ in Q122

By yearend, analysts expect rents to trend higher to about 5%.

MPA inks 3 agreements on ammonia value-chain

Two of the three MoUs were made with ITOCHU Corporation.

Which property segments will gain the most interest from investors in 2022

The relaxation of COVID measures is expected to attract a higher inflow of investors this year.

Market Update: STI down 0.64%

Jardine Matheson was seen with the most growth.

Advertise

Advertise

Commentary

Singapore’s family offices: Time to professionalise or risk falling behind

Liquidity crucial to stock market reform