Over 1 in 5 firms at worse position after an economic crime

Only half conducted an investigation following a fraud incident.

More than a quarter of Singapore enterprises, or 28% indicated that they are in a worse position after being hit by an economic crime incident, up from only 31% in 2018, a survey by PwC revealed.

More than half or 51% of Singapore enterprises revealed that they have been hit by economic crime due to external sources in the past year, up from only 31% in 2018.

Despite this, only 51% of companies conducted an investigation when a fraud incident occurred.

Customer fraud tops the list of all crimes experienced in Singapore at 46% in 2020 from 32% in 2018.

Further, larger companies are more likely to have higher occurrences of economic crime, with 24 percentage points (ppt) more companies with an annual revenue of over $1.39b (US$1b) reporting economic crimes or fraud (53%) as compared to those under $695.36m (US$500m) (29%).

In contrast, the proportion of internal perpetrators fell to 28% from 54% two years ago.

Compared to their global peers, Singapore enterprises are more likely to be in a similar or worse position following a fraud incident, with 69% of companies surveyed indicating this. On the other hand, 55% of organisations globally felt that they were in a similar or worse place following an incident.

Singapore-based companies were also less likely to feel like they ‘acted as a team’, with only 38% saying this compared to 47% globally. Less Singapore firms also said that they had access to key data information and leveraged it appropriately at 28%, in contrast to 39% worldwide.

Furthermore, only one in 3 or 33% of Singapore firms are prepared or have followed a plan in regards to such incidents, compared to 43% globally.

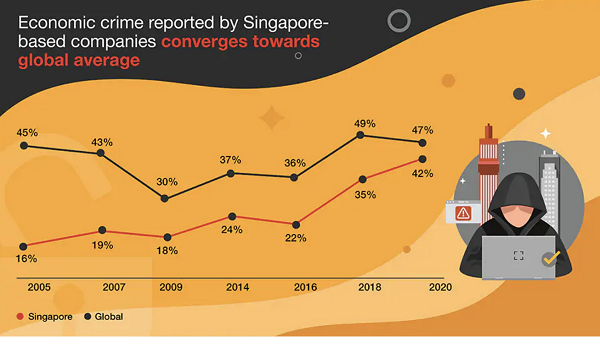

“Singapore-based entities are still reporting fewer incidents of economic crime than the global average, but this year’s results should be a warning that more needs to be done to maintain that position. Whilst informal risk assessments may seem sufficient, this could lead to companies looking in the wrong places and only protecting against the most common crimes, bringing about a false sense of security,” said Michael Peer, Singapore forensic leader at PwC South East Asia.

“A formal risk assessment will allow companies to have a thorough view of where their vulnerabilities lie. Companies can then invest in the right places to mitigate potentially significant operational, financial or reputational impact. As the saying goes, it’s better the devil you know than the devil you don’t,” Peer concluded.

The Global Economic Crime and Fraud Survey examines over 5000 responses from 99 countries, with 93 respondents in Singapore.

Advertise

Advertise