Chart of the Day: Here's a comprehensive history of Singapore's property cooling measures

Curbs will likely be eased soon.

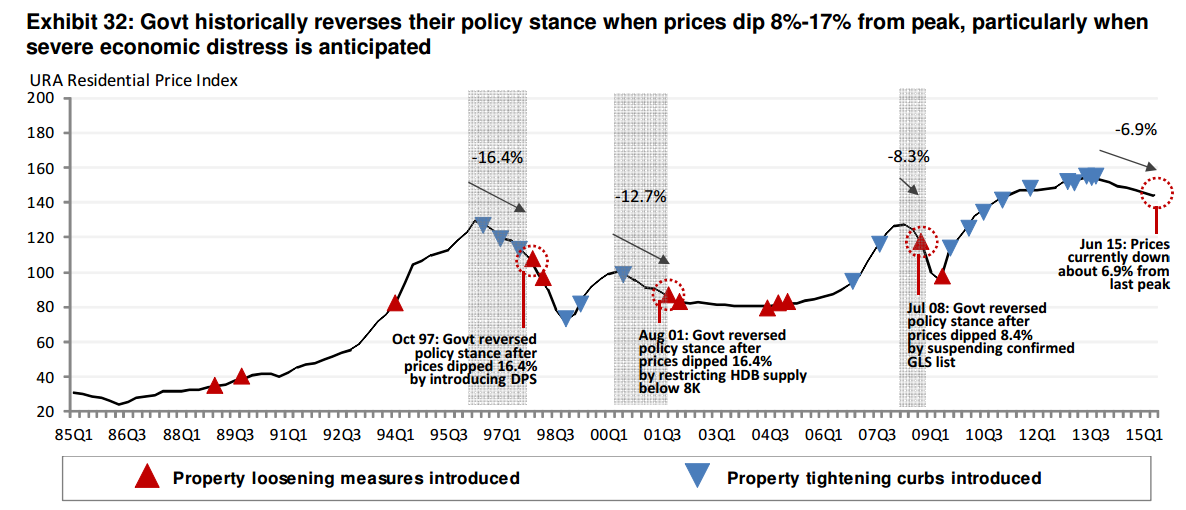

History tends to repeat itself, and analysts at OCBC are betting that based on past trends, some of Singapore's current property cooling measures are due to be eased soon.

OCBC said that since 1985, there have been three instances in which the government has reversed property curbs.

In October 1997, for instance, the government reversed its policy stance after prices slipped by 16.4%. Policymakers introduced the Deferred Payment Scheme (DPS), which allowed developers o offer to purchasers of uncompleted private residential, commercial and industrial properties the option to defer part of the progress payments due after the initial 20% downpayment, to a later stage.

In August 2001, the government restricted HDB supply after prices dipped by 12.7%.

More recently in July 2008, the government reversed its stance after prices declined by 8.4%.

“Since 1985, we found three examples of the Singapore government reversing into a property loosening stance. These were also times when significant economic stress were anticipated. We believe the government has a strong track record of actively reviewing its property legislation and would intervene if prices accelerate excessively to the downside,” OCBC said.

With overall home prices currently down by about 6.9% from its last peak, OCBC believes that a selective easing is on the cards.

The likeliest easing candidate will be the Additional Buyers' Stamp Duty (ABSD), given its straightforward impact on buyer demand.

“Given that the ABSD is a percentage upfront tax on property purchases that has a straight-forward impact on demand, we believe it is a likely candidate for adjustment if and when the authorities reverse policy stance to support homes prices. Another measure under this scenario is that the government will restrict land supply from its government land sales (GLS). The remaining measures are more structural in nature, and are more likely to cause derivative impact on the banking system and developer moral hazard," the report noted.

Advertise

Advertise