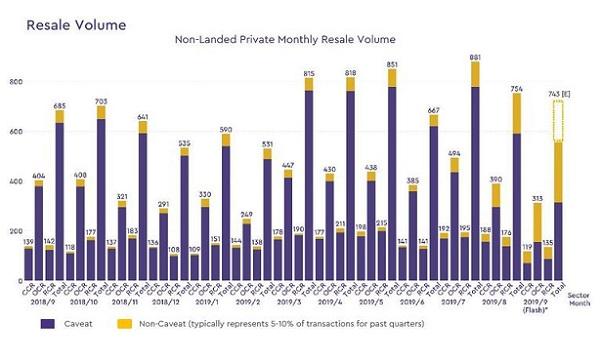

Private condo resales down 1.5% to 743 units in September

On a YoY basis, transaction volumes rose 8.5%.

Transaction volumes for private non-landed resales fell for the second straight month by 1.5% MoM to 743 units in September, according to the SRX Price Index. On a YoY basis, the figure rose 8.5% and is also 5.1% higher than the five-year average.

Also read: Private condo resales down 13.6% to 751 units in August

OrangeTee & Tie said in a comment that resales have traditionally dropped in September then rebound in October since 2015.

"Buyers will usually return to the market after the seventh lunar month which ends in August but it takes time for the sales to be converted. The sales transactions may only be reflected about two months later," OrangeTee wrote.

Also read: Ghost Month spooks subside as home sales surge 81%

Over half or 53.1% of the volume came from outside central region (OCR), whilst 28.2% and 18.7% came from rest of central region (RCR) and core central region (CCR) respectively.

Resale prices inched up 0.2% MoM and 0.8% YoY in September, led by CCR where prices picked up by 1.8% YoY. This is followed by OCR and RCR where prices rose by 0.6% and 0.2% over the same period.

The priciest units resold during the month came from the TwentyOne Anguilla Park and 3 Orchard-By-The-Park sold at $32m. The biggest transacted price for one units in RCR and OCR came from Carribean at Keppel Bay for $6.3m and Mandarin Gardens for $3.5m respectively.

Median transaction over x-value remained unchanged from the previous month at -$10,000. District 9 posted the highest median at $54,400, whilst District 12 showed the lowest at -$45,500.

Advertise

Advertise