Chart of the Day: Check out the biggest losers in Singapore stock market

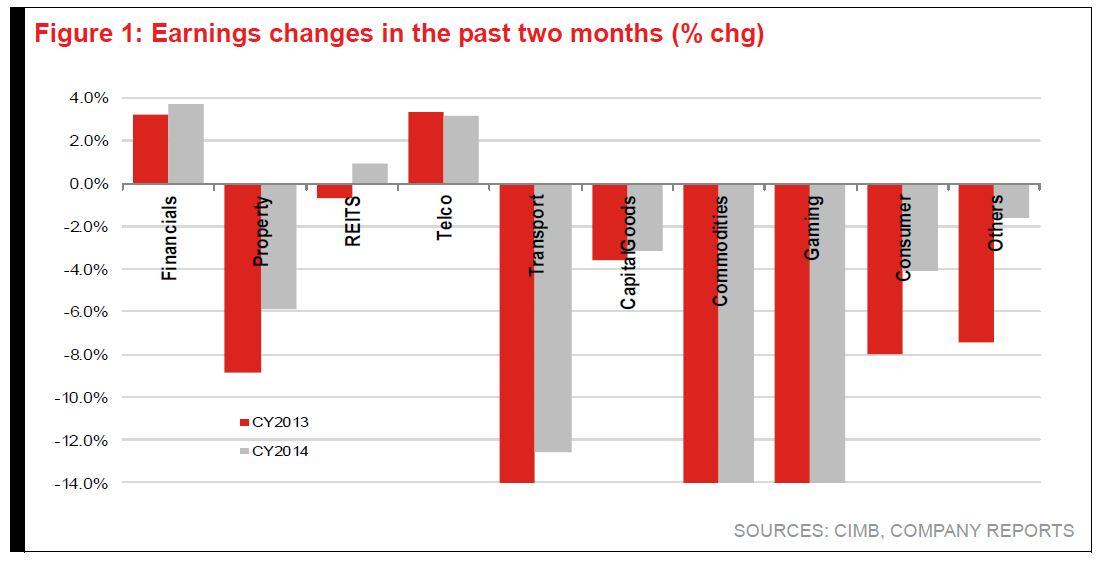

Gaming sector gravely disappoints.

According to CIMB, while the Singapore market scales new highs, like stockmarkets around the world, it is the yield stocks and the stocks with earnings predictability that have outperformed.

The results season showed just why – earnings for cyclical sectors continue to see cuts.

Here's more from CIMB:

In contrast, earnings were upgraded for banks, telcos and REITs. When investors look for stocks today, they want yield and earnings visibility.

We see no reason for this to change. Yes, we are in a “safety” bubble and it looks likely to inflate further.

Data points from the 1Q13 results season do not provide any meat to stray from the safety bubble anyway.

The number of misses outnumbers the outperformers. Tellingly, EPS cuts are coming from most of the externally exposed sectors.

We provide a Corporate Singapore trendbook here, identifying three most distinct trends in each sector, gleaned over 1Q. We are incrementally positive on telcos, financials, property and consumer but more negative on capital goods, commodities and transport.

Advertise

Advertise