Stocks

SGX RegCo proposes a new enforcement framework in the securities market

SGX RegCo proposes a new enforcement framework in the securities market

The firm aims to have powers on cases that call for public sanctions that the LDC can hear.

Sembcorp Industries, Sembmarine respond to shareholder queries

Both firms assured that the demerger deal is in the best interests of shareholders.

Sea Group's shares surge 880% in 18 months: report

It recorded the largest gain worldwide amongst companies with a $1.34b market value.

Alibaba Pictures to delist from SGX-ST on 4 December

Upon delisting, the shares will only be traded on the Hong Kong Stock Exchange.

SGX to roll out two REIT futures

Both futures are designed to allow broad distribution to US and global institutional investors.

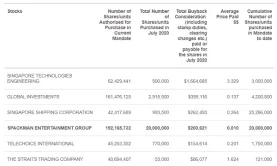

Total share buyback value plunges to $2.9m in July

The low level of buyback consideration coincided with a 2.3% decline in the STI.

SGX's profit up 21% to $472m in FY2020

All revenues from FICC, equities and data, connectivity and indices rose.

Daily Markets Briefing: STI down 1.7%

OCBC Bank saw the sharpest decline amongst top active stocks with a 3.82% contraction.

Singapore Paincare Holdings now listed in SGX

All of the 24.25 million placement shares were subscribed, collecting around $5.33m.

SGX RegCo warns against reporting earnings before coronavirus

Its use was found to be unreliable and misleading.

Daily Markets Briefing: STI down 1.26%

AEM saw the sharpest decline amongst top active stocks with a 4.62% contraction.

SGX RegCo, Nasdaq inks deal for an enhanced framework on secondary listings

This allows the required SGX listing files to be based on information contained in the US listing.

Daily Markets Briefing: STI down 0.2%

DBS saw the sharpest decline amongst top active stocks with a 1.02% contraction.

Daily Markets Briefing: STI up 1.02%

Medtecs International led the gains amongst top active stocks with a 7.53% expansion.

Buyback consideration hit $663m in H1

DBS, OCBC and UOB saw the highest amount of buyback consideration.

Ascott Residence Trust announces 3.07% reset rate for unredeemed perpetual securities

The next reset date is on 30 June 2025.

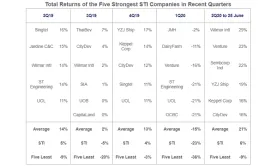

Bourse's six top stocks outpace STI in Q2

Wilmar leads the pack with a 29% return.

Advertise

Advertise

Commentary

Singapore’s family offices: Time to professionalise or risk falling behind

Liquidity crucial to stock market reform