Stocks

Daily Markets Briefing: STI up 0.55%

Daily Markets Briefing: STI up 0.55%

SGX led the pack amongst top active stocks with a 2.11% climb.

Singtel's Optus issues $334.57m 5-year notes and $477m 10-year notes

Both will be issued on 1 July and are guaranteed by Optus and certain subsidiaries.

Hong Leong Asia extends deadline on Tasek takeover bid

It aims to acquire the remaining shares in the cement manufacturer.

Alibaba Pictures to delist from Singapore stock exchange

Voting rights and entitlement to dividends of the CDP Depositors will not be affected.

Daily Markets Briefing: STI down 0.72%

OCBC saw the sharpest decline amongst top active stocks with a 1.7% contraction.

Mapletree Industrial Trust to join STI on 22 June

This will bring the indicative combined weighting of STI to 12.5%.

Parkson Retail Asia queried over ‘unusual' trading activity

The company said it does not know any explanation behind the trading.

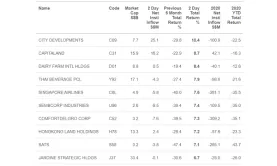

STI returns crashed 17.6% to 4.1% YTD

However, returns are on a path of recovery as its constituents bounced back from its lows.

Singapore Savings Bond's July issue opens at 0.3% for the first year

The first interest payment is slated to be on 1 January 2021.

SGX inks MSCI Singapore license agreement

It will also launch 10 Singapore Single Stock Futures products.

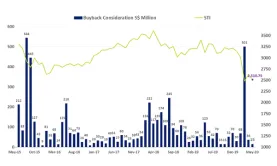

Share buyback value halved to $14.9m in May

ST Engineering led the pack as it bought back 2 million shares for $6.31m.

Keppel Corp prices $424.71m notes due 2025 at 2.46%

Net proceeds will be used for general corporate or working capital purposes.

Reduced MSCI offerings could slam SGX's FY2022 earnings: analyst

Futures movement may move to its rival in Hong Kong.

Total company dividends to drop 4.5% in 2020

UOB is expected to suspend its special dividend for 2020.

SGX plunges most in 17 years as MSCI signs pact with HKEX

The move deals a blow to SGX, which considers the Hong Kong bourse one of its main rivals.

Daily Markets Briefing: STI down 2.17%

OCBC saw the sharpest decline amongst top active stocks with a 4.5% drop.

Singtel upholds share of Bharti Airtel's provision at $357m

The telco says that it will be an exceptional item in its financial results for Q1 and FY2020.

Advertise

Advertise

Commentary

Singapore’s family offices: Time to professionalise or risk falling behind

Liquidity crucial to stock market reform

From ownership to access: Unlocking vehicle productivity in Singapore