Chart of the Day: Office rents are falling down, falling down, falling down

Grade A office rents dropped 17% to just $9.50psf.

Now may be as good a time as any to move to that new office space with rents due to stabilise after more than a year of gentle declines, according to analysts.

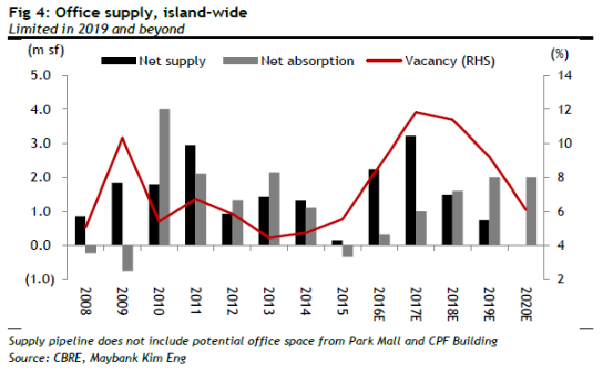

After more than doubling since the lows of the financial crisis, Grade A office rents have fallen for the last five consecutive quarters and are now down 17% to an average of just $9.50 psf. But now all those cranes that built much of the new office space in the Marina Bay area are about to fall silent with just one new office block due to be completed in 2019 within the CBD.

Since 2009 Singapore has been able to finish and lease an average of 1.4 mn sq ft of office space a year, but that will drop to 900sq ft in 2019 and 2020 is looking even sparser with just one new office site up for grabs on Central Boulevard. The only saving grace for landlords is that despite much lower rents, capital values have held up. From their respective peaks, office rents have lost 17% but capital values just 5%, according to Maybank Kim Eng.

Duncan White, head of office services at Colliers International, Singapore, says that there are two main factors among many others that caused the rents to fall for the last five quarters. “Firstly, rentals have been dropping due to global uncertainties, and along with the oversupply in Singapore, occupiers are uncertain about future positions,” he says.

Tay Huey Ying, Head of Research, JLL Singapore adds that rents have been pressured since 1H15. “The combination of a large influx of new office supply in the Central Area in 2016 and 2017 amounting to 3.6 million sq ft and dwindling demand owing to the weak and uncertain economic environment that saw numerous businesses (particularly in the oil and gas as well as financial industries) consolidating their operations and reducing their real estate footprint, had placed downward pressure on rents since the first half of 2015.” She points to the uncertain business environment as one of the reasons that pushed businesses to adopt a cautious stance with regard to expansion plans and real estate commitments and this further clipped demand for office space and pressure down rents.

The Central Boulevard site is an interesting case in point. Asia Square Tower 1 is currently the closest comparable and when sold in Sep 2007 Grade A office rents were around SGD15 psf in 3Q07 and rose to peak at almost SGD19 psf in 3Q08. This led to an aggressive price of SGD1,409 psf paid for that site. Fast forward to today and rents have slid from their last peak of SGD11.40 psf in 1Q15 to SGD9.50. That’s quite a fall, and one which may now be about to come to an end.

Tay explains the phenomenon extensively. Since 2H 2011, the Government had not placed Central Area office development sites in the Confirmed List of the GLS programme given the substantial supply that will be built up from the earlier GLS programmes as well as the six plots of land at Marina Bay and Ophir Road/ Rochor Road to be jointly developed by M+S Pte Ltd arising from the landmark land swap deal for the former Malayan Railway land. Instead, the Government focused on releasing sites outside the Central Area such as Jurong, Woodlands and Paya Lebar, to facilitate the realization of its vision of decentralising employment centres and bringing jobs closer to homes.

However, she said that the government continued to place office sites in the Central Area in the Reserved List to provide opportunities for the market to initiate the development of more office space if there is demand. Of these, only two sites have been triggered for sale, one of which is currently being developed into Frasers Tower. The other site at Central Boulevard was recently triggered and launched for sale and tender is due to close on 8 November.

"Hence, the lack of vacant sites made available for office development in the Central Area via the GLS Confirmed List had significantly slowed down new office completions to an annual average of just 0.5 million sq ft from 2018 to 2020, including private sector redevelopment projects," Tay adds.

White, on the other hand, points out that the issue here is not that developers are building less offices, but rather it's about an oversupply of space. "We feel that in the recent past, the opposite is true - there is a dramatic oversupply in the market which has driven rentals down as occupiers have more opportunities to choose from. This means that landlords would need to improve their rents and terms in order to attract and retain tenants. Developers are not so much building less office sites, but rather taking stock of the current over supply in the market in order to build and deliver a finished product to the market at the opportune time," he justifies.

Advertise

Advertise