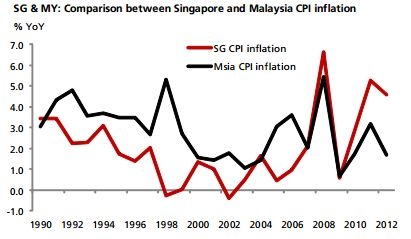

Chart of the Day: Singapore now worse than Malaysia in controlling inflation

But the gap in inflation is set to narrow this year.

According to DBS, the gap in inflation between both economies is set to narrow although most recent inflation figures are still diverging. Indeed, both countries announced their December and 2012 inflation yesterday and the contrast can’t be starker.

Here's more from DBS:

Inflation picked up to 4.3% YoY in Dec12 for Singapore. That brings 2012 full year inflation for the island-state to 4.6%. But across the strait, Malaysia’s inflation dipped further to 1.2% in the final month of the year and ended with an annual average inflation of just 1.7%. That’s a wide gap of about 3%-pt between the both sides on the inflation front last year.

Yet historically, Singapore used to perform better when it comes to controlling inflation. Average inflation for the past 20 years for Singapore is 1.9% versus 2.8% for Malaysia. So Singapore used to have the upper hand on inflation but somehow has been losing its edge in this aspect in recent years.

So what gives? Firstly, COE premiums shot through the roof when the transport authority decided to unwind on its previously more liberal policy stance and to cut back the monthly COE quota from about 13K in 2004-07 to about 3K presently.

A booming property market due to the negative real mortgage rate, as well as the curbs in foreign labour have further exacerbated the inflationary pressure. While the MAS has continued to embark on a tight exchange rate policy in a bid to curb inflation, the bulk of the existing inflationary pressure is the result of self-imposed policies.

And these are beyond the scope of the externally oriented exchange rate regime. In contrast, Malaysia is comfortably enjoying one of the lowest inflation rates in the region, helped by a stable interest rate policy and the domestic price stability programme.

But these will change going forward. Malaysia’s current subsidy programme may prove unsustainable. A cut back is possible after the impending election to ensure longer term fiscal sustainability. Moreover, Malaysia has recently introduced the minimum wage. Companies will surely pass on this higher wage cost to consumers and this will drive inflation higher to about the 3% by the middle of the year. Full year 2013 inflation is expected to register 2.8%.

Separately, Singapore’s inflation will start to run sideway, hovering around the 4% mark for the rest of the year. While those factors that have been keeping inflation at such higher than normal level will persist, a sharp spike up is unlikely given the sluggish pace of growth and lapsing of the earlier inflationary policy effects. Full year inflation is projected to average 4.0%. In short, we should see the gap in inflation between these two neighbouring states narrowing this year.

Advertise

Advertise