Inflation rate hits 0.6% in 2019

This is the fifth year the headline rate has failed to go over 1%.

Singapore’s headline inflation rose 0.6% YoY for the whole of 2019, marginally higher than 2018’s level of 0.4% YoY. This is the fifth consecutive year that the headline CPI has failed to go over 1% YoY, according to OCBC Treasury Research.

“Slowing gains in raw food prices, relatively subdued healthcare costs and negative contributions from imputed rentals are main reasons for this structural change that has been observed in the past half-decade,” said Howie Lee, economist for global treasury at OCBC Bank.

Core inflation also rose 1.0% YoY – the lower end of MAS’ comfort range of 1-2% and the slowest since 2016. “Deflationary pressures from the utility basket due to the Open Electricity Market (-1.3% YoY) and relatively benign gains in the healthcare (1.1% YoY) and raw food (1.1% YoY) baskets contributed to the soft showing in core inflation this year,” Lee said.

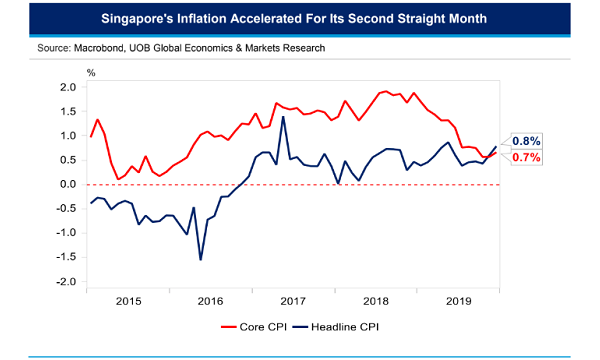

For December 2019, headline inflation accelerated for the second straight month to 0.8%. Core inflation inched up to 0.7%, the fastest pace since September.

According to UOB economist Barnabas Gan, higher-than-expected inflation print was driven by price increases in private road transport, services and food. Private road transport rose by 3.1% YoY, extending the nine months streak of gains since April 2019. This is due to higher Certificate of Entitlement (COE) premiums (+21.9% YoY) and Brent crude oil (+21.9% YoY) prices in December. Services inflation also increased by 1.3% YoY, on the back of higher fees in telecommunication services, education services and airfares.

For 2020, OCBC’s Lee expects deflationary pressures from imputed rentals to continue normalising towards the neutral territory. “Additionally, consumer savings from the OEM are likely to have already been largely factored in last year, whilst the start of 2020 suggests higher oil price volatility as a result of Middle East unrests could be a common feature,” he said.

External sources of inflation are also expected to stay benign in the quarters ahead amidst weak demand conditions, said UOB’s Gan. “The Monetary Authority of Singapore (MAS) and the Ministry of Trade and Industry (MTI) also kept its dovish rhetoric surrounding Singapore’s labour market conditions,” he added.

Advertise

Advertise