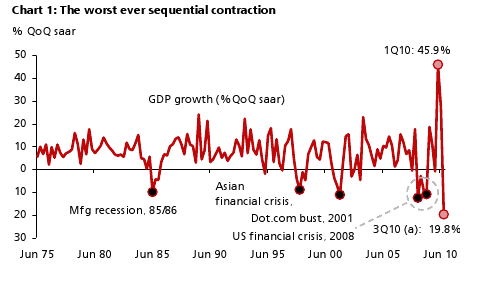

Singapore economy just hit a brick wall - worst quarterly drop since 1975!

News just out today from the MAS shows the economy hit a brick wall, contracting an unprecedented 19.8 % quarter on quarter.

According to DBS Bank, this is a record sequential contraction and one that is worse than the supposedly

“free-fall” in GDP experienced in the recent US financial crisis, the slump during the

dot.com bust as well as the doldrum during the Asia financial crisis.

Indeed, noted DBS, growth wouldn’t have fallen by more dramatic fashion than this

considering that we had a record expansion not too long ago in the first quarter.

Sharp pullbacks in production from the volatile pharmaceutical segment have

brought down overall industrial production in recent months. "And the

exceptionally high comparison base in 1H10 further amplifies the drop. That is, it’s

drug effects plus technical payback!"

"But isolating these volatilities, Singapore’s underlying growth momentum is

slowing and much in line with the normalization process in Asia with the V-shaped

recovery turning into a square root shape. And more than ever before, the

prospect of the Singapore economy is more closely tied to Asia than anywhere in

the world. Hence, this normalization process that is currently underway in Asia will

soon be manifested in Singapore’s economic growth numbers, except with some

doses of volatilities coming from the pharmaceutical industry from time to time.

Our full year GDP growth remains at 15%," noted DBS

The Monetary Authority of Singapore (MAS) surprised the market yet again after

the “double-barrel” move in April. This time, the MAS has steepened the slope of

the Sing NEER policy band as well as widened the width of the band. While it could

reflect the general optimism in terms of growth outlook by the authority, it is also a

pre-emptive move to address inflationary concern ahead. Indeed, the focus is on

inflation in the coming months as external inflationary pressure is expected to pick

up on higher commodity prices. Moreover, with the prospect of another

quantitative easing move by the US Fed, inflows will be strong and upward

pressure on the SGD will be even greater. The widening of the band will in some

ways cater to an anticipated greater volatility in the FX market going forward, noted DBS.

View the graph here.

Advertise

Advertise