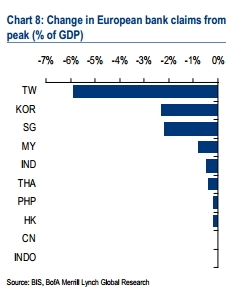

Chart of the day: EU's deleveraging in Asia fairly smoothly

Economies with biggest contractions in EU claims include Singapore.

According to Bank of America Merrill Lynch, Asian banks sourced US$2,500bn from banks in the EU, US, Japan etc in 2011. US$ funding was about 9% of total Asian bank assets and 20% of the region’s GDP. Given Europe’s deleveraging over the past several quarters, the credit supply from EU has been reduced by US$119bn, or 9%.

BofAML however notes that lending from other regions, such as the US and Japan, has remained solid.

"Asian banks have gone through EU’s deleveraging fairly smoothly, in our view. Taiwan, Korea and Singapore have seen relatively big contractions in EU bank claims amounting to 2-6% of their GDP," it said.

Hong Kong meanwhile posted less than 1% contraction.

Advertise

Advertise