Chart of the Day: Which bank is most exposed to Mainland China?

Profits will take a hit if defaults spike.

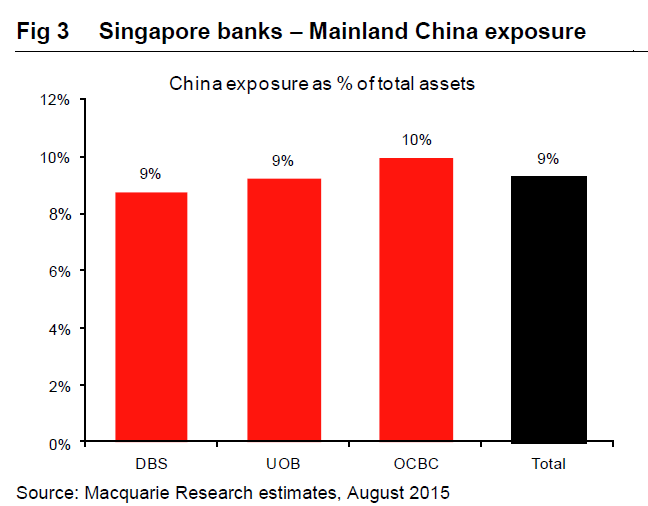

Singapore's three largest banks have substantial exposure to Mainland China, as this chart from Macquarie shows.

China accounts for around 9% of total assets for DBS, OCBC and UOB. OCBC is the most exposed with 10% of assets in the Mainland, while China accounts for 9% of assets for both DBS and OCBC.

China exposure accounts for 10% of OCBC's pre-tax profit, compared to 9% for UOB and 6% for DBS.

Macquarie said that should the RMB weaken by 10% against the Singapore Dollar, the banks' pre-tax profit would be trimmed by less than 1%.

If China assets decline by 20%, Macquarie noted that pre-tax profit will shrink by around 2%.

"OCBC will be the most impacted, due to the relatively higher net RMB asset exposure arising from RMB loans and placements with banks," the report noted.

Advertise

Advertise