Sale of loss making e-commerce business could push SingPost earnings by up to 20.3%: analyst

It is divesting Jagged Peak and TradeGlobal to focus on regional operations.

Singapore Post’s (SingPost) sale of its US e-commerce businesses Jagged Peak and TradeGlobal is expected to boost its earnings 17.6-20.3% per annum, according to a report by CGS-CIMB.

Following its strategic review, SingPost announced that it would commence the process of selling its US e-commerce unit to focus on its operations and growth opportunities in Southeast Asia and Asia Pacific.

SingPost first ventured into the US e-commerce business in October 2015, with an initial stake acquisition of 71% in Jagged Peak ($22.5m), followed by a 96.3% stake purchase of TradeGlobal ($236m). However, US operations have been largely unprofitable for the firm,, according to CGS-CIMB analyst Ngoh Yi Sin.

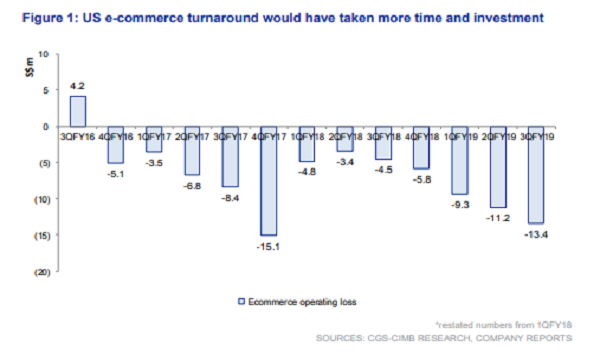

Whilst the e-commerce segment saw higher volumes in Q3 driven by festive shopping in the US, operating losses rose amidst intensive competitive pressures. It further added that the underperforming US businesses was expected to remain loss-making going into 2019.

“A combination of intensifying competition and customer bankruptcies have resulted in widening losses over the past quarters despite revenue growth, suggesting that the US operations have yet to achieve optimal scale and operating leverage, with a turnaround likely to be costly and longer than expected,” she explained.

This sentiment was echoed by a report by DBS Equity Research in 2018, which noted that SingPost’s turnaround could take two to three years following continued US e-commerce losses, which widened to $11m, as some contracts were renewed at lower rates following price pressures.

Also read: SingPost's turnaround may take three years as US losses widen

Apart from the e-commerce woes, intensifying competition in North Asia that affected logistics’ profitability, the impact of terminal dues changes on international mail volumes, and lapses in service standards for domestic postal mail which resulted in a total $400,000 fine for 2017-2018, have weighed on SingPost’s earnings, added Ngoh

“We think these major concerns have been priced in, and share price re-rating is on the horizon as the group delivers on sustained improvements in both the postal and logistics segments,” she said. “We think the US e-commerce business could be worth at least $70m-$80m.”

Following the decision to exit US e-commerce operations, CGS-CIMB predicts that SingPost will seek to preserve its domestic market share in last mile delivery by enhancing service quality, and defend its postal margins via increasing automation and reliance on the postal network.

Also read: SingPost enables postmen to track deliveries with mobile app

Another growth priority for the group would be leveraging its Alibaba partnership to drive logistics volumes and margin, to which management hopes to achieve close to 5-6% operational performance management (OPM) in the next two years, the report revealed.

“Whilst committed to its key capabilities in Asia and ASEAN, we see potential gaps in SingPost’s end-to-end ecommerce strategy, which could be bridged by synergistic mergers and acquisitions (M&As),” Ngoh added.

“SingPost also owns a sizeable real estate portfolio of $1b investment properties as at end FY3/18, of which Singapore Post Centre (SPC) accounts for $859m. There are other properties which may not be fully utilised and currently form part of its long-term assets (FY18: $532m) that has not been revalued,” she highlighted. “We see the potential to further unlock value in these properties (including some of the legacy post offices) in the longer term, either through possible sale or higher rental income.”

Advertise

Advertise