Asia

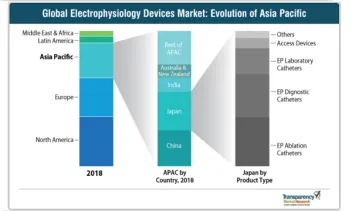

Electrophysiology devices market to grow 9% annually

Electrophysiology devices market to grow 9% annually

The prevalence of diseases in India and China is expected to raise demand for the devices.

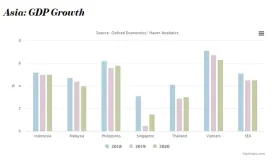

Vietnam bullish on GDP growth over construction sector boost

Projections on GDP growth has been raised from 6.5% to 6.9%.

Indonesia inflation rate dips to 3.39% in September

Food prices have dipped.

Taipei, Nanjing join cities emerging as property hotbeds

They are noted for their improved quality of life, innovation, and sustainability.

Indonesia telcos' revenue could grow 9% in 2019: analyst

The big three are aggressively monetising data services.

SEA online economy grows 39% to $100b in 2019

The online economies of Indonesia and Vietnam grew 40% and led the growth in the region.

Taiwan gears up for shift to electric motorcycles

The government pushes to ban ICE motorcycles by 2023.

Power projects to drive growth of Asia's bond market

Issuances in RE and LNG infrastructure are expected to increase.

Chinese property developers can withstand currency depreciation despite sales dip

The companies’ strong revenue will stand as buffers to renminbi depreciation.

China's outbound M&A likely to stabilize in H2: Natixis

More deals in July and improved offshore financing indicates more outbound activity for the period. Chinese companies may pursue more overseas acquisitions in the H2 amidst a slowing local economy and increasingly low return of assets in China, according to a research by Natixis. Newly announced acquisitions in July indicates that the number of M&A deals by Chinese companies may rise in the second half of the year, in contrast to the trend of decreasing transactions recorded in Q2 and H1, Natixis noted. For example, the automobile company BAIC has just acquired a 5% stake in Daimler, a German automotive corporation. Another reason for the foresight in outbound M&A is the improvement of offshore financing by a dovish FED. Although trade tensions have increased restrictions, dealings with EU stands to have more leeway. EU-27 is still the main target acquisition by China, followed by countries in Asia Pacific and the US. Before Russia topped the value deals of China, EU-27 accounted for about one-third of China’s value deals in cross-border acquisitions in H1, and which largely came from the completed stake purchase in Finland’s Amer Sports. The EU remains to be the most important target of China’s investments in the industrial sector and is also starting to attract Chinese corporates’ attention in the consumer sector. Looking forward, Chinese companies would reportedly prefer to invest in the information and communications technology, as well as the industrial and consumer sectors as these are aligned with the government’s strategic objectives.

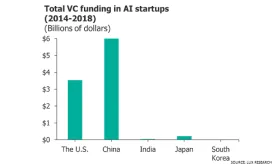

China still lags in AI innovation race despite besting US in patents

Despite scoring $6.1b in funding for its AI startups, Chinese companies may find it hard to capture the Western market. Although investments into China's AI startups dwarf the rest of the world - almost 70% higher than those in the US - a report from LUX research suggests that China has yet to fully cement its status as a global AI leader.

Private sector eyed to boost $233B of Vietnam's infra projects

A draft PPP law is expected to reinforce the inflow of private capital.

India's highway construction to slow to 26-27 km per day in FY19-20

Steep land acquisition costs are partially to blame.

SEA bosses ill-prepared for economic downturn: Bain

This overconfidence might leave them stagnant unlike companies who grew during the last recession.

SEA economic growth to slow to 4.5% in 2019

Regional GDP growth already cooled to 4% in the first half of the year.

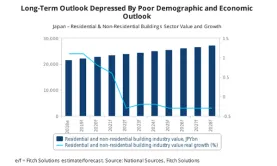

Japan's building sector to grow 0.4% annually from 2019-2023

Urban redevelopment projects will drive growth amidst shrinking housing demand.

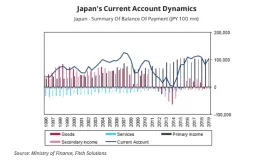

Japan's current account surplus to narrow to 3.2% of 2019 GDP

Export growth is expected to drop 1.2% this year.

Advertise

Advertise

Commentary

Singapore’s family offices: Time to professionalise or risk falling behind

Liquidity crucial to stock market reform