Asia

Asia's cruise passenger market up 4.6% to 4.24 million in 2018

Asia's cruise passenger market up 4.6% to 4.24 million in 2018

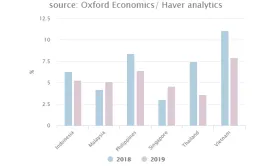

China remains the top source market, accounting for 55.8% of Asian passengers. Asia’s cruise passenger source market hit a new high in 2018, with 4.24 million people going on an ocean cruise, up 4.6% YoY, according to data released by Cruise Lines International Association (CLIA). Most of the source markets in Asia saw year-on-year gains in 2018, including Singapore (39.9% to 373,000), India (28.1% to 221,000), Indonesia (54.9% to 72,000), Philippines (49.1% to 61,000), South Korea (13.5% to 44,000), Thailand (14.5% to 30,000) and Vietnam (53.7% to 10,000). Meanwhile, data showed that mainland China retained its dominance as a source market, accounting for 55.8% of all Asian passengers, though the Chinese market has been going through a period of adjustment and saw a marginal 1.6% decline in passengers. The more measured increase in Asia’s passenger volume did not come as a surprise, as cruise ship capacity dipped in 2018 after years of rapid expansion in this region, according to the report. Asia’s slowdown in ship capacity is due to the strong demand for cruise ships worldwide, and reduced short cruise itinerary options ex-mainland China. “In the next few years, cruising in Asia is expected to continue growing in popularity with the arrival of new ships in 2019/2020 including from Costa Cruises, Genting Cruise Lines, Royal Caribbean International and MSC Cruises,” CLIA managing director for Australasia & Asia Joel Katz explained. Asia continues to be the cruise industry’s third largest market after North America and Europe, the CLIA figures show, maintaining a 14.8% share of the total global ocean passenger volume (28.5 million) for 2018.

South Korea's industrial output up 1.4% in March

The electronics giant has been showing a slowdown in MoM declines.

APAC manufacturing recovery not imminent: report

A buildup of investors has led to an oversupply in the electronics sector.

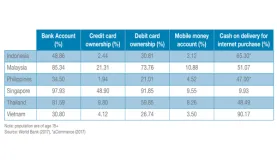

Is cash still king in ASEAN?

Card penetration for some countries fall below 50%, according to a study.

Japan's commercial property market to rise despite tight conditions

Prime rents within Tokyo’s 23 CBDs pushed to $71.57 per 1,420 sqft per month, a cyclical high for stock of this nature.

APAC manufacturers could lose $10.7m from cyberattacks

Over half of APAC manufacturing organisations have experienced a cyber breach.

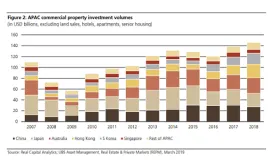

APAC commercial property investment hit $163b in 2018

Investments in office, retail and industrial properties hit a new high of $146b.

Vietnam GDP rose 6.8% in Q1

The growth was mainly driven by agriculture, forestry and fishery, industry and construction, and services.

China slowdown to weaken APAC cross-border sentiment in 2019

Chinese corporates' onshore funding costs are forecasted to fall further.

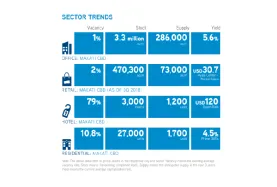

Metro Manila's office vacancy rates firm at 5% in 2018 despite 36% supply growth

Philippines Economic Zone Authority-accredited buildings attracted the most tenants.

Malaysia inflation down 0.4% in February

Lower fuel pump prices and high year-ago base effects weighed on the CPI.

Chinese banks suffer heavy losses as delinquencies hit $17.88b in January

The energy sector saw the most defaults of $6.94b.

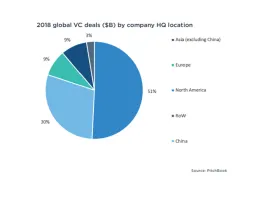

China's VC deal value surged 89% to $78.2b in 2018

Chinese startups clinched almost 1 in 3 global VCs.

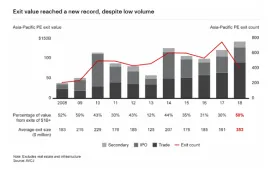

APAC private equity exits hit $142b in 2018

The surge in exit values outpaced the previous all-time high of $125b recorded in 2014.

Median deal multiples for PE-backed M&As set a new record in 2018: report

Deals focused on restructuring, carve-outs and turnarounds rose in value to more than triple the previous five-year average.

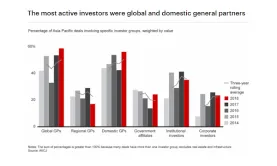

$883b of Asia Pacific assets ate up 26% of the global private equity market in 2018

The region's deal value rose to $165b in 2018, exceeding the all-time high of $159b in 2017.

Southeast Asia GDP to slow down to 4.8% in 2019

Volatile export and manufacturing sectors are challenging the region’s economies.

Advertise

Advertise

Commentary

Liquidity crucial to stock market reform

From ownership to access: Unlocking vehicle productivity in Singapore

Why Singapore schools need AI policies now: A chemistry teacher’s warning