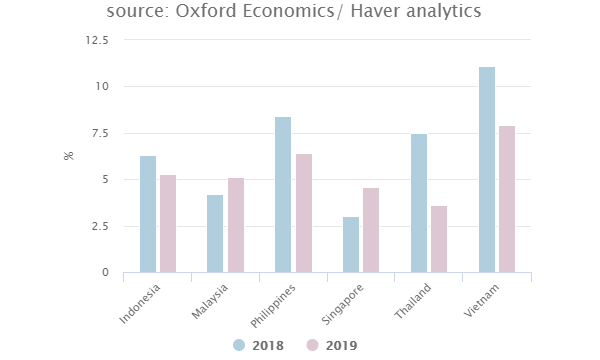

Southeast Asia GDP to slow down to 4.8% in 2019

Volatile export and manufacturing sectors are challenging the region’s economies.

The woes of Southeast Asian economies are expected to continue in 2019 no thanks to a challenging export environment, The Institute of Chartered Accountants in England and Wales (ICAEW) said. The region’s GDP growth is expected to moderate to 4.8% this year from 5.1% in 2018 before easing to 4.7% in 2020.

Regional merchandise exports growth in US$ terms tumbled in December, contracting 2.3% on the year, following a weak outcome (2.2%) in November. “The deterioration in export momentum was broad-based, with only Malaysia recording positive annual growth, although this follows some normalisation in mining production following earlier supply disruptions,” ICAEW said.

“And whilst Singapore and China data showed some improvement in exports in January, the data is likely to be volatile in Q1 given the shifting timing of Chinese New Year,” it added.

High-frequency data also points to further weakness ahead in the manufacturing and export sectors. In January, ICAEW’s aggregate measure of the Asia PMI slipped into contractionary territory (below 50) for the first time since May 2016. Whilst Southeast Asia countries fared better than their North Asia counterparts, Indonesia and Malaysia both reported readings below 50.

Weaker Chinese import demand is also a challenge despite an improved outlook on the US-China trade negotiations. “We also do not expect the increase in trade protectionism over the past year to be removed anytime soon,” ICAEW said.

Given the challenges, domestic demand is expected to cushion the region from trade headwinds. According to ICAEW, the region’s central banks no longer face as much pressure as last year amidst the recent change in the Fed’s rhetoric and lower external financing concerns (due to oil prices declining and currencies stabilising).

As a result, most central banks are expected to keep policy rates unchanged well into the second half of 2019 amidst muted inflationary pressures. “Fiscal policies are also likely to be supportive of growth in the region, particularly in Indonesia, the Philippines and Thailand ahead of upcoming elections in H1 2019,” ICAEW added.

However, private capex, especially in machinery and equipment (M&E) investment, has been on a downtrend in some of the places where export growth has notably decelerated – such as in Singapore and Malaysia.

“Residential investment will also be held back by demand and supply imbalances in both these economies. However, we expect construction, particularly infrastructure investment, to limit the downside to overall investment,” ICAEW added.

Meanwhile, ICAEW expects benign inflation conditions and rising real income growth to continue to support household spending.

Advertise

Advertise