Office space leads Singapore's property scene as deal value jumps 53.5% in 2019

It was led by the sale of Chevron House, which was bought at $1.03b.

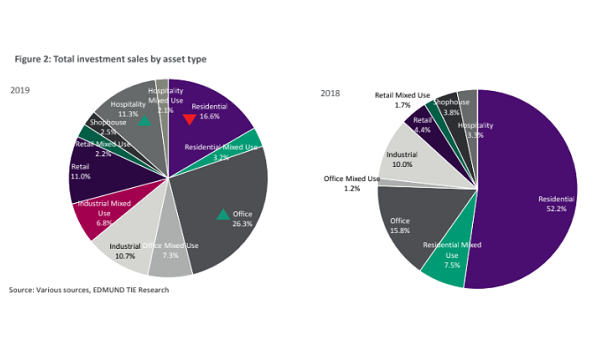

Total investments in the office property scene surged 53.5% YoY in 2019, based on total private sector deals and GLS sites, according to a report by EDMUND TIE. Notably, it now accounts for most of the total property investment value at 26.3% from 15.8% in 2018.

The report stated that it was supported by investors’ confidence in office space demand and positive outlooks for the sector as viable source of stable income-recurring assets.The largest transaction in 2019 was Chevron House, which was bought at $1.03b ($2,739 psf) to US investment firm AEW from Oxley Holdings.

The price is said to represent over 35% increase in capital value over the $660m that Oxley Holdings had initially paid to acquire the development in March 2018.

In addition, occupancy rates of office developments rose 2.5 percentage points (ppt) YoY to 94.9% in Q4 2019, showing a faster growth compared to the 0.9 ppt growth in Q4 2018. During the same period, occupancy in the Central Business District (CBD) edged up the most by 3.3 ppt YoY to 95.6%.

Co-working and technology firms remained the major occupiers of CBD office space, despite challenges faced by selected co-working operators such as WeWork and Wotso. EDMUND TIE also observed some co-working operators expanding into the CBD fringe locations, in light of the near saturation of co-working spaces in the district. An example is JustCo, which opened its 50,000 sq ft of space in Manulife Centre and is expected to house about 1,000 members.

As for its rents, the report stated that average gross monthly rents inched up across most of the sub-locations by 0.0 to 1.7% in Q4. Average CBD rents rose 1.3% QoQ and 7% YoY in Q4 2019.

The total supply pipeline from Q4 2019 to 2023 is estimated to be approximately 4.7m sqft (or 1.1m sqft per annum). However, the office market is projected to expand in terms of footprint and leasing activity at a moderated pace in 2020, in line with Singapore’s modest economic recovery.

But demand could remain healthy in the CBD, driven by the information & communications and finance & insurance sectors. EDMUND TIE added that firms providing asset management and legal services could be on the lookout for office spaces as inbound investment to Singapore is expected to step up on the back of investors’ search for investment destinations in Asia.

Advertise

Advertise