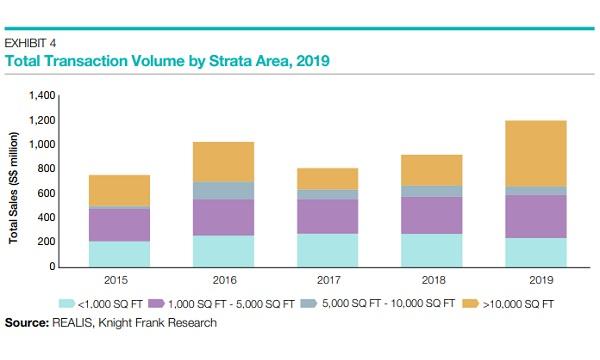

Strata office sales jumped 30.4% to $1.2b in 2019

Their average price rose 8.8% as more were sold in prime locations.

The total value of strata-titled office units sold in 2019 leapt 30.4% YoY to $1.2b, according to a Knight Frank report. Q4 sales particularly skyrocketed 159.8% to $369.5m.

Despite a decline in caveats lodged for strata-titled office units to 303 in 2019, compared to 332 in 2018, the average price transacted per square foot in this year rose 8.8% as more buyers picked more offices in prime locations.

The number of transactions priced above $2m grew to 115, from 97 deals, whilst those that are priced below $2m dropped to 188 units from 235 units. The average prices of strata-titled offices also expanded 9.7% for freehold and 9.1% for leasehold units, reflecting the sudden jump in sales in Q4.

“Buyers bought more strata-titled offices in prime locations such as the Singapore River and Orchard planning area in 2019, while a considerable proportion of units purchased are located within the Downtown Core planning area,” the report stated.

The Singapore River planning area especially saw its caveats more than triple YoY to 49 caveats in 2019. There were also more units in the Orchard and Rochor planning area sold in the year.

Median rents of office spaces at the Singapore River planning area likewise climbed 3.0% YoY, noting that these appealed to investors that sought safe assets that offer higher returns than government bonds.

“The limited supply of strata-titled units in the Central Business District and Orchard Road also means the values are likely to be kept up barring any economic shocks,” the report added.

Meanwhile, sales activity in Kallang dived from 49 to 29 caveats, whilst those of Jurong East dwindled from 14 to 3 caveats.

Furthermore, most owners of strata-office properties that enjoyed phenomenal returns were also noted to hold their properties for at least 10 years. For instance, freehold units at United House, Thong Theck Building, and Grandlink Square reaped 306%, 265%, and 154% returns, respectively, after being transacted in 2019.

In some cases investors profited by good timing, like that of Level 10 of Suntec Tower, where Hong Realty bought it in for $29.84m in 2018 and reportedly sold it in January 2020 for $7.6m or 26% higher.

Advertise

Advertise