Chart of the Day: Here's how risky Singapore banks' China exposure can get

Despite loans being trade-driven.

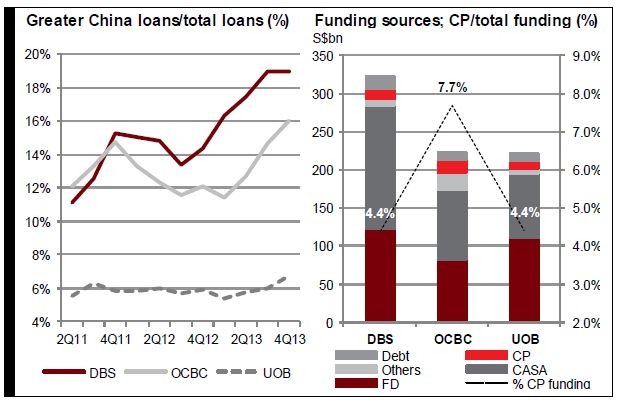

According to CIMB, the main concern over Singapore's banks centred on their growing Greater China exposure. DBS and OCBC clarified that the bulk of their Greater China loans are trade-related loans.

The chart shows rising exposure to Greater China for DBS and OCBC but both banks have explained that their China loans are almost solely trade-driven.

Here's more from CIMB:

They have little exposure to domestic lending and will resilient on any spillover effects of a shadow banking breakdown. The funding of these trade loans might be via commercial papers (CPs), but the total dependence on CP funding is relatively low.

OCBC CEO Samuel Tsien explains that its trade loans rose 94% yoy in 2013, driving most of its Greater China exposure.

Its loans to domestic China exposure barely changed at S$3bn-4bn (~2% of group loans). OCBC’s Greater China loans are mostly trade loans booked in Singapore, while loans to Hong Kong are to top-tier Hong Kong corporates.

DBS CEO Piyush Gupta explains that the China-related trade funding market is a large market and growing fast. Part of it is funded onshore by the Chinese banks and part of it is funded offshore.

DBS estimates that 70% of this trade have come out of China, with companies initially moving their treasury functions to Hong Kong but increasingly, also diversifying to Singapore.

Such trade loans drive most of DBS’s Greater China exposure. We note that the Greater China loan exposure of DBS and OCBC has grown from 11-12% of group loans in 2011, to 16-19% at end-2013.

Comparatively, UOB has grown this pie slower than peers, with its Greater China loans maintaining at 6% of group loans. UOB says that its Greater China exposure include loans to large Hong Kong corporates and China SOEs with headquarters in Hong Kong.

Advertise

Advertise