Grade A office rents up 3.2% in Q1 as supply tapered off

Occupancy has recovered to a healthy 95.2%.

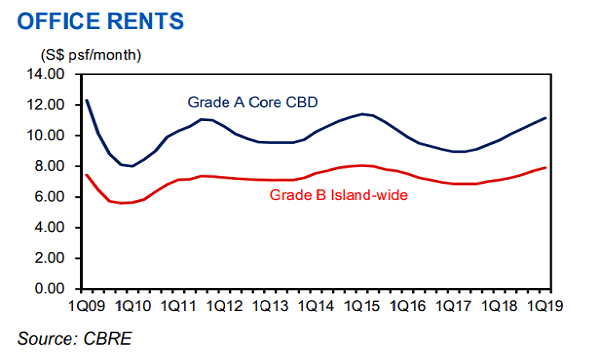

Grade A office rents edged up 3.2% QoQ to $11.15 psf pm in Q1 2019 as supply tapered off in the core Central Business District (CBD), a report by UOB Kay Hian (UOBKH) revealed.

According to UOBKH analysts Jonathan Koh and Peihao Loke, supply eased to 1.3 million sqft in 2019, of which only 228,958 sqft was within the core CBD.

Overall, Singapore’s office market has progressed to its second year of recovery after it bottomed out in H1 2017, driven by strong demand from technology firms including fintechs and startups, and banking and insurance services.

The analysts also noted that occupancy for Grade A office space within the core CBD experienced a v-shaped recovery from the trough of 91.6% in Q3 2017 after the completion of Marina One (East Tower and West Tower) with 1.9 million sqft of office space. “Occupancy has recovered to a healthy 95.2% in Q1 2019,” they highlighted.

Whilst the market share of co-working firms still remained small at 2.3%, operators had a strong appetite for expansion, with the market doubling in size to 1.4 million sqft in 2018, driven by a boom in venture capital and private equity in the region.

Koh and Peihao added that leasing interest for upcoming new developments is projected to be fairly healthy. “Net absorption of office space is at 137,936 sqft in Q1 2019, comparable to 149,444sf in Q1 2018,” they said, adding that the first quarter of any year is usually seasonally softer.

Future supply is estimated at 5.33 million sqft for 2019-22, representing an average of 1.36 million sqft per annum, which is 29% below the 10-year average of 1.91 million sqft.

CapitaLand Commercial Trust, which is said to be the CBD’s largest landlord with Grade A office buildings accounting for 81% of its net lettable area (NLA) portfolio, 51-storey redevelopment of Golden Shoe Car Park, to be renamed CapitaSpring, is scheduled for completion in H1 2021. It will comprise 635,000 sqft of office space, 12,000 sqft of retail space and a food centre of 44,000 sqft.

“Supply of new office space is manageable at only 899,781sqfr in 2021, which poses minimal competition for CapitaSpring,” the analysts highlighted, adding that Rochester Commons with 264,781 sqft of office space is located at one-north.

Advertise

Advertise