Commercial Property

Shophouse volume jumps as average prices sink to $4,663

Shophouse volume jumps as average prices sink to $4,663

Total transactions rose to 54 in H2 2025 despite 27% slide in psf prices.

REITs to resist slump as economy slows to 2.1%

Portfolios defy cooling 2026 momentum as supply remains tight.

Investors chase shorter leases as industrial prices outrun rents

Trade and political risks force a shift toward factories with less than 30 years remaining on leases.

Science Park vacancy hits 20% as rents jump 5.7%

City fringe business park rents also grew by 1.3% YoY with a 10% vacancy rate.

Private home prices slow to 0.6% growth in Q4 2025

Landed homes post strong gains as non-landed prices decline.

Suntec REIT DPU hits $0.07, up 13.6% YoY in 2025

This was driven by stronger Singapore operations and lower financing costs.

Industry space to cross 1 million sqm as factory stock expands

Single-user factories make up over half of the new supply.

Tight supply, lower interests drive Grade A office rents up 2.4% in 2025

A more decisive occupier activity was seen during the year.

ERA urges ABSD rethink as HDB resale growth slows to 2.9%

ERA floats buy-first windows of 6–9 months for movers, plus easier older collective sales and longer remissions.

Low Keng Huat offeror lifts stake to 84.17% at $0.78

The $0.78 cash offer closes 5:30 pm on 13 Feb 2026 after a final price revision on 20 Jan.

Oxley axes Malaysia JV as Posh Properties enters liquidation

The liquidation will not affect the company’s earnings per share.

Investment sales hit $11.5b as commercial deals explode 277%

Major retail transactions at Clementi Mall and PLQ Mall drove the quarterly commercial rebound.

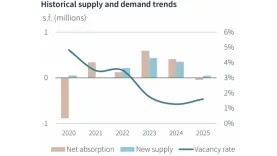

Industrial capital values surge despite six-quarter rental plateau

Full-year space additions reached an eight-year high following a surge of completions in early 2025.

Retail rents hit $37.78 as underperforming stores exit

Retail rents rose 0.6% even as businesses abandoned more space than they occupied in Q4.

CBD office rents break 15-month stagnation as new supply hits zero

Economic resilience and business recovery terminate five quarters of sub-1% movement.

Cuppage Terrace hits market amidst Orchard Road redevelopment wave

The asset was valued at $250m in 2025.

CapitaLand Ascendas REIT acquires $94.5m US logistics site from DHL unit

The property will be leased back to DHL.

Advertise

Advertise

Commentary

Singapore’s family offices: Time to professionalise or risk falling behind

Liquidity crucial to stock market reform