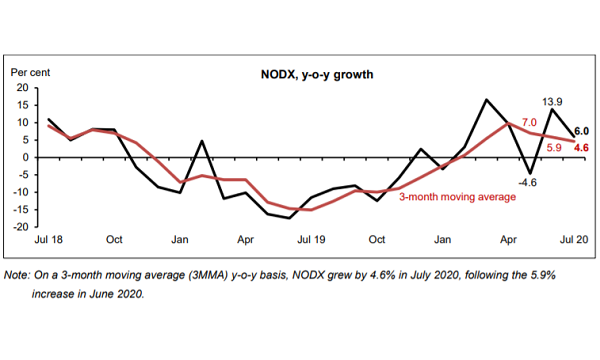

NODX up 6% in July

Both electronic and non-electronic exports rose, albeit at a slower pace.

Singapore’s non-oil domestic exports (NODX) has inched up 6% YoY in July, a weaker figure compared to the 13.9% expansion in the previous month, according to data from the Enterprise Singapore (ESG).

On a MoM seasonally adjusted (m-o-m SA) basis, NODX rose 1.2% in July, after the previous month's 1.4% decline. The level of NODX reached $14.1b in July from $14b in June.

Electronic NODX grew by 2.8% YoY in July, easing from the low-base driven expansion (+22.2%) in the previous month. Disk media products, telecommunications equipment and ICs jumped 23%, 18.2% and 1.5% YoY respectively, contributing the most to the growth in electronic NODX.

Meanwhile, non-electronic NODX edged up 6.9% YoY over the same period, from the 11.7% expansion in the previous month. Non-monetary gold (+227.9%), specialised machinery (+60.1%) and pharmaceuticals (+15.5%) contributed the most to its growth.

NODX to the top markets as a whole grew in July, albeit declines in exports to Indonesia, Thailand, Hong Kong, China and the EU 27. Exports to the US (+98.7%), South Korea (+56.3%) and Taiwan (+18.7%) led the pack.

In addition, NODX to emerging markets crashed 22% in July, no thanks to South Asia (-29.9%), the Caribbean (-56.4%) and the Middle East (-22.7%).

Non-oil re-exports (NORX) dipped 2.8% YoY, after the 5.4% growth in June. Electronic NORX grew 11.9% in July 2020, led by ICs (+8.5%), parts of PCs (+40.3%) and telecommunications equipment (23.6%). In contrast, non-electronic NORX contracted 15.8% due to non-monetary gold (-60.0%), piston engines (-62.7%) and aircraft parts (-23.1%).

NORX to the majority of the top 10 markets grew in the same month, except for Malaysia, China, Japan and Indonesia. The top three contributors to the increase in NORX were Hong Kong (+20.5%), the US (11.4%) and the EU 27 (+8.5%).

On a MoM basis, non-oil retained imports of intermediate goods (NORI) rose $1.1b from $6.1b in June to $7.2b in July. Meanwhile, oil domestic exports plunged 50.9% YoY amidst lower oil prices. Lower exports to Indonesia (-59.3%), the EU 27 (-87.8%) and Malaysia (-33.4%) contributed to the YoY contraction of oil domestic exports. In volume terms, oil domestic exports dropped 29.4% YoY in July.

As a result, total trade slipped 8.9% YoY in July. Total exports fell 7.9% YoY, whilst total imports dipped 9.9% YoY. On a SA basis, the level of total trade reached $75.8b in July, compared to $73.9b in June.

Advertise

Advertise