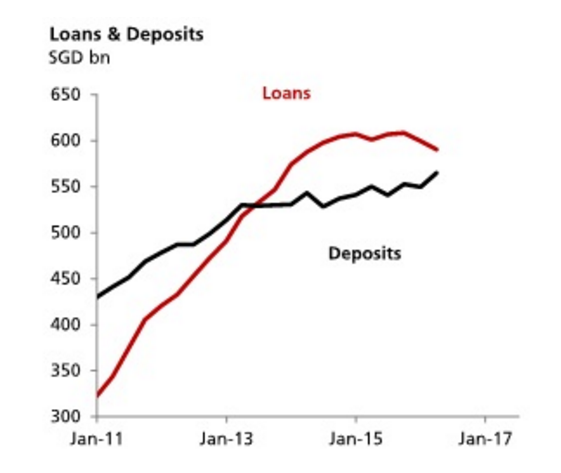

Chart of the Day: Local liquidity conditions improve as rate hike jitters wane

Deposits are on the rise.

Liquidity conditions in Singapore have improved significantly in recent months. This chart from DBS shows that deposits have climbed steadily although loan numbers have eased, while foreign reserves have also started to creep up.

"This suggests that domestic liquidity is sufficient to offset upward pressure on Singapore dollar rates resulting from Singapore dollar weakness for now," DBS said.

DBS expects the premium of Singapore dollar rates over US dollar rates to stabilise as the market pushes out the possibility of another interest rate hike by the US Federal Reserve.

“Typically, US dollar strength tends to be associated with higher US dollar/Singapore dollar forward points and therefore higher SORs. However, the bout of US dollar strength in recent weeks did not have much impact on Singapore dollar interest rates. With the Fed unlikely to resuming hiking just yet we suspect Singapore dollar rates are likely to trade within range in the near-term,” the report said.

Advertise

Advertise