Singapore's IPO proceeds skyrocketed 182% to $1.55b in H1 2019

The growth was boosted by the two US REITs that accounted for 96% of total funds raised.

Singapore’s H1 2019 initial public offering (IPO) capital market outperformed the same period in 2018 with nine offerings, resulting in $1.55b in proceeds and a market cap of $2.24b, data from Deloitte revealed.

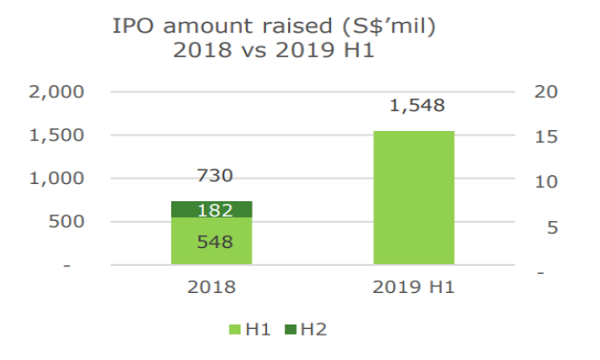

The city-state’s IPO market funds surged 182% compared to H1 2018, where seven IPOs raised an aggregate $548m in proceeds.

Also read: Singapore IPO proceeds plunge to $730m in 2018

The higher funds raised in H1 2019 were mainly due to the two US real estate investment trusts (REITs) listed on the Singapore Exchange’s (SGX) mainboard. These comprised of ARA US Hospitality Trust, the first listed US hospitality trust on the local bourse, which priced its stapled securities at $1.19 (US$0.88) apiece, whilst Eagle Hospitality REIT’s 580.56 million securities were offered at $1.06 (US$0.78) apiece.

“These two REITs accounted for 96% of total funds raised with $1.49b (US$1.06b) in proceeds as at IPO,” Deloitte said.

The remaining seven company IPOs, all listed on the Catalist, raised a total of $58.53m, with the gross amount raised by each of the seven Catalist IPOs ranging from $3.9m to $15m. During the same period last year, each of the six Catalist IPOs listed then raised gross amounts ranging from $4.5m to $54.7m.

According to Tay Hwee Ling, Deloitte Southeast Asia and Singapore’s global IFRS & offerings services leader, SGX has been an attractive bourse of choice for both domestic and foreign trusts.

“Looking at the performance of the Singapore IPO market in the past 3.5 years, foreign issuers have contributed to 64% of the total IPO amount raised of $9.2b on the SGX from 2016 to the first half of this year,” she said.

The US and China emerged as the top two foreign countries in terms of total IPO amount raised from 2016 to 30 June 2019, Deloitte observed. Trusts from the US raised the highest amount at $2.7b since 2016.

Apart from the US and China, a good variety of geographies including Australia, Europe and across Asia, have IPOs on SGX.

“In fact, in the first six months of 2019, there was an increase in proportion of overseas companies listing on SGX. There were seven foreign company IPOs, accounting for 78% of the total number of IPOs, as compared to 33% of the total number of IPOs in the whole of 2018,” the firm highlighted.

Trust IPOs accounted for 17% of the Singapore IPO capital market from 2016 to 30 June 2019. In the last 3.5 years, there were 10 trusts listed on the SGX, with 90% of trusts listed on the SGX being foreign trusts, including assets from the United States, China, Europe and Australia.

Also read: SGX ranked as world's tenth best IPO bourse by proceeds in Q2: study

Meanwhile, in terms of non-trust IPOs listed on SGX in the past 3.5 years, IPOs from Singapore saw the highest count and total amount raised.

“SGX is also an attractive listing destination of choice for both Singapore companies and foreign companies. A total of 29 foreign companies listed on SGX from 2016 to the first half of the year, accounting for 48% of the total number of IPOs that listed on the bourse over the last 3.5 years. There is also diversity of industry amongst these companies, ranging from businesses in real estate, consumer products, technology, media & telecommunications, energy & resources, life sciences & health care, financial services and industrial products” said Tay.

From an industry perspective, the total funds raised in the Singapore capital market in the last 3.5 years were driven by the real estate sector, whilst the consumer products sector had the highest number of IPOs.

Real estate companies have been dominating Singapore’s IPO market over the years, having raised $5.7b between 2016 to 30 June 2019, accounting for 62% of the total IPO amount raised in that period.

Also read: REITs eyed to boost Singapore's IPO landscape

“In the first six months of 2019, this trend was relatively consistent, with real estate IPOs accounting for 96% of the total proceeds raised. The IPOs from the technology, media and telecommunications sector accounted for 27% of the total amount raised since 2016, mainly due to the listing of Netlink NBN Trust in 2017,” Deloitte noted.

The consumer products sector had the highest count of 18 IPOs, accounting for 6% of total amount raised since 2016.

Whilst the Hong Kong Stock Exchange (HKEx) continues to be attractive due to the perceived high valuation, the reality of factors such as the recent high rejection rates, lower subscription rate for IPOs and increasing professional fees are being felt, the report stated.

“There is a pipeline of domestic and cross border IPOs from companies in the service-based sectors, and we remain confident that companies in service-based business will continue its growth with IPOs on the SGX,” Tay highlighted, adding that the partnerships that SGX has forged in recent years with NASDAQ and TelAviv Stock Exchange (TASE) will continue creating opportunities for companies in the technology and health care sectors to co-list in the exchanges.

On 27 June, KinderWorld International Group reportedly lodged its preliminary prospectus with the Monetary Authority of Singapore (MAS) for IPO on the SGX mainboard.

Advertise

Advertise