High-yield non-financial Asian firms' default rate to rise 2.4% in 2020

China has been seeing an increased tolerance of defaults.

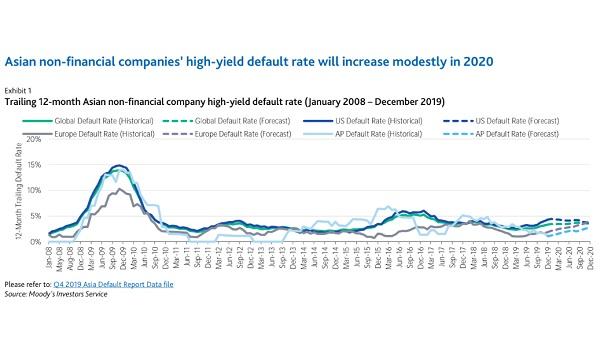

The default rate for high-yield non-financial companies in Asia is projected to rise to 2.4% in 2020, compared to 1.1% in 2019, reports Moody’s Investors Service. This can translate to about five potential defaulters in a year.

This figure is based on the assumption that the average US high-yield spread will edge up to 401 basis points in 2020, from 395 basis points in 2019, and that the GDP weighted average unemployment rate in Asia will climb from 3.7% to 3.8% over the same period.

Further, slowing economic growth in major economies as well as continued trade policy uncertainty will likely continue to weigh in on companies’ financial profiles.

The default risk of Chinese companies is especially expected to persist in 2020 amidst an increased tolerance of defaults, including that of state-owned enterprises (SOEs), by the government due to a de-risking campaign.

“The government will likely let distressed companies rely on markets-based solutions while bailouts will become more selective,” the report stated.

For instance, commodities trader Tewoo Group fell short of repaying its USD-denominated debt in December, recording the largest default amongst SOEs in China for about two decades, which could suggest that the government is being more selective on bailing out SOEs.

Still, the default rate is expected to remain at a low level, as major central banks are anticipated to maintain accommodative monetary policies. This can mean that most rated companies in the region will maintain access to funding and debt service capabilities.

The high-yield default rate for Asian non-financial companies fell to 1.1% at the end of 2019, from 3.0% at the end of 2018. Moody’s recorded four rated defaults in 2019, with three coming from Chinese issuers.

Globally, the default rate is projected to edge up to 3.5% at the end of 2020, from the 3.4% at the end of 2019. The default rate in Europe is expected to rise, whereas it is tipped to decline in the US.

Advertise

Advertise