How to win the Singapore startup game

By John FearonIf you have a startup in Singapore, ignore the business plan, financial projections, valuations, and statistics (for now) – look at yourself – are you the kind of CEO that investors will want to spend $1 million USD to have coffee or champagne with?

The entrepreneurial path is lonely, desperate and poor, which often end in sadness. Statistic Brain estimates that 50% of all startups fail by the 4th year. To be one of the few who emerge successful, the first key is to be “believable”, the minimum gantry to a successful business.

Be it the spirit, passion, enthusiasm or emotional connection / blackmail, CEOs of startups get seed investments because of who they are, not what they do. Even the most resourceful entrepreneur will know that being the guy or girl that investors believe in is the surest way to secure the initial seed funding to get started.

As the movie “The Social Network” and Facebook’s “About Us” page would us have believe, Mark Zuckerberg got his initial capital from his then-best friend, Eduardo Saverin to start Facebook. At that point, Saverin may or may not have believed in the business but he did believe in his best friend.

Friends and family aside, angel investors and venture capitalists also often look past the fancy colorful PowerPoints and spreadsheets to see the “People Equity”. Felix Salmon, Financial blogger at Reuters, in his post “Buying Equity in People” says:

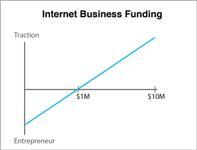

“Venture capitalists are increasingly investing in a startup’s management team rather than in its business model or underlying idea. Find the entrepreneur and invest in the individual directly, thereby guaranteeing that you’ll have a stake in their success if and when they finally hit it rich on their fifth or sixth attempt.” (see Figure 1)

In the simple graph above that generalizes the startup financing scenario, to make a mark on the tech scene, startups will usually have to raise up to $1 million USD in the seed round. This benchmark may vary from business to business (this figure may rise up more when developing a physical product). The initial sums raised are usually made in the entrepreneur, not the business.

When an entrepreneur raises the hallowed $1 million USD mark, the hurdle turns to a spur to edge the business on – where the traction can take over. It is a psychological hurdle that prevents many startups from going further. With 6 zeros in the bank, there is sufficient cash to scale up (hiring of new staff, improving equipment, purchasing of advertising and etc).

The alternative to this emotional personality-based funding is to consider bootstrapping – which is defined as a self-sustaining process that proceeds without external help - like lifting oneself up off the ground by grabbing one’s boots but without any leverage. This describes about every startup founder / entrepreneur – with an idea but strapped for cash.

Seasoned entrepreneurs will know that bootstrapping is not to be taken verbatim. According to a study conducted by SBA (Small Business Administration), about 33% of all the newly set up companies that venture with bootstrap financing stumble. At the beginning, with just an idea, a few scratches and pictures in a “business plan”, no one will invest.

The most basic requirement for a founder / CEO of a startup is to be inspire others to believe in himself/herself.

To secure investment, convince others to join the startup, keep the staff at the start up, find more investors to keep the business afloat and more requires personality, guile, glib and conviction. To get through the thin so to reach the thick, entrepreneurs will have to, at all times, be the inspirational person to friends, family, staff and investors alike.

Perhaps if this requirement is too tough, more sociable co-founder or co-founders can be added to the team. Sparkling CV holders or advanced business degrees are of course welcome additions to the team to increase the people equity.

Most entrepreneurs start the same way, borrowing money and looking for investment from family, friends, angels and VCs. Increasingly so, these investors are not buying into the business model but they are buying into the entrepreneur’s potential. The investment is not in the moneymaking business but in the million-dollar entrepreneur.

Advertise

Advertise