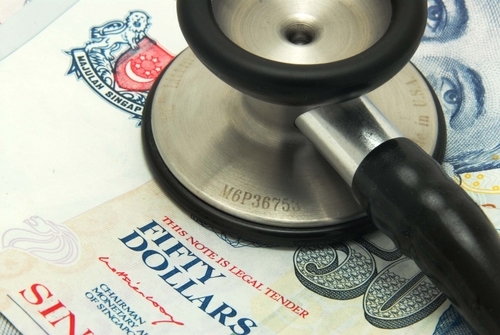

More than half of Singaporean families don’t have life insurance

It seems like Singaporeans aren't thinking too far ahead in the future.

Many families in Singapore, including those with children, are not recognising the risks of not having life insurance protection. More than half of all parents in Singapore (53%) who are surveyed do not have individual term life insurance despite having dependent children, according to a global study of attitudes to retirement and financial planning by HSBC.

Furthermore, among parents in Singapore who do have financial plans for their families, a quarter of them (24%) do not have any type of life insurance included in their plans. When it comes to gender differences in exercising financial decision-making, the survey also found that men in Singapore are generally more proactive than women in making financial decisions in the household concerning both retirement planning and household budgeting.

These findings have emerged from HSBC’s The Future of Retirement programme which is a leading independent study into global retirement trends.

“We are seeing a major protection gap where many Singapore families, especially those with dependent children, are failing to recognise the benefits of life insurance protection. Unforeseen events such as early death or serious illness can lead to a loss of breadwinner’s income, leaving loved ones saddled with debts that are difficult to repay and a lower quality of life than they could have had. Life insurance is widely available in the Singapore market and in different forms tailored to individual needs at various life stages. It is a fundamental form of protection which is essential for all families,” said Mr. Walter de Oude, Chief Executive Officer of HSBC Insurance in Singapore.

HSBC’s new report points to a myriad of evolving financial needs as individuals and families go through various life stages. Globally, only 50% of respondents on average say they have a financial plan in place. The situation in Singapore is not dissimilar where 58% of respondents here have made financial plans. Despite having made these plans, there still appears to be significant gaps in their financial planning throughout adult life.

In Singapore, nearly half (48%) of those respondents aged 30-39 say they have no short term savings. Only 30% of those married or living together aged 40-49 are protecting their assets. Despite life insurance being widely available and all working parents having a need for this kind of protection, 24% of parents do not have any life insurance policy. Of those aged 50-59, 34% do not have retirement plans while only 12% are undertaking tax planning. Eight in ten (80%) of all parents have not made a will.

Mr. de Oude said, “Many parents are not taking adequate steps to ensure financial security for their families now and into the future. Starting a family is an important decision, along with important milestones like marriage and home ownership. It is really advisable to review your financial situation at major moments in life, in particular when having children and planning for their future education expenditure. If you have dependents, all the more you need to be proactive in making long-term financial plans that cover the whole family in good as well as difficult times.”

Singapore women lag behind men in household financial decisions Men are taking the lead in decision-making across most aspects of financial planning. Globally, 65% of men say they make all or most of the financial decisions in the household, compared to 53% of women. Men in Singapore are slightly ahead of the global trend, with 70% of them making all or most of such financial decisions compared to 52% of women.

Men in Singapore are more proactive than women in making financial decisions in the household concerning retirement planning, with 38% of them assuming sole responsibility in this area compared to 21% of women.

This reflects a gender divide when it comes to household decision-making relating to retirement planning, mirroring the global trend where similarly, 39% of men take responsibility for such decisions compared to 25% of women. A significant finding is that across Asia, women in Singapore are least likely to be responsible for making decisions on saving for retirement, deferring to their male partners. The study found that the discrepancy between the sexes in planning for retirement is consistent across all age groups, suggesting that attitudes to this aspect of the family finances are not changing over time. Interestingly, East Asian countries such as China, Taiwan and South Korea display the greatest gender equality in retirement planning.

The gender gap narrows slightly when it comes to financial decisions relating to managing the household budget. Globally, women (37%) are more likely to take sole responsibility for managing the household budget compared to men (34%). The inference seems to be that women are much more focused on short-term financial matters than longer-term retirement planning.

Even here, this gender gap disappears among those in their thirties, with younger men taking a stronger interest in domestic budgeting than those in older age groups. In Singapore, however, the situation is reverse where only 28% of women take the lead in making decisions on managing the household budget compared to 32% of men. This means that men in Singapore still exercise more control than women in financial decisions on both retirement planning

and household budget.

“Preparing for retirement is a key aspect of financial planning, and their relative lack of involvement may leave women potentially exposed to financial hardship in later life. While it might be practical for one partner to take the lead in research or action, decisions should be discussed and made jointly on a fully informed basis. This willhelp ensure that families are better prepared for the future and that women are less financially vulnerable. It has also been a constant endeavour of HSBC to educate our customers and provide them with the right solutions through customer research,” said Mr. de Oude.

Advertise

Advertise