Singapore average mortality protection gap hit highest in Asia

Large awareness of life insurance failed to translate to more coverage.

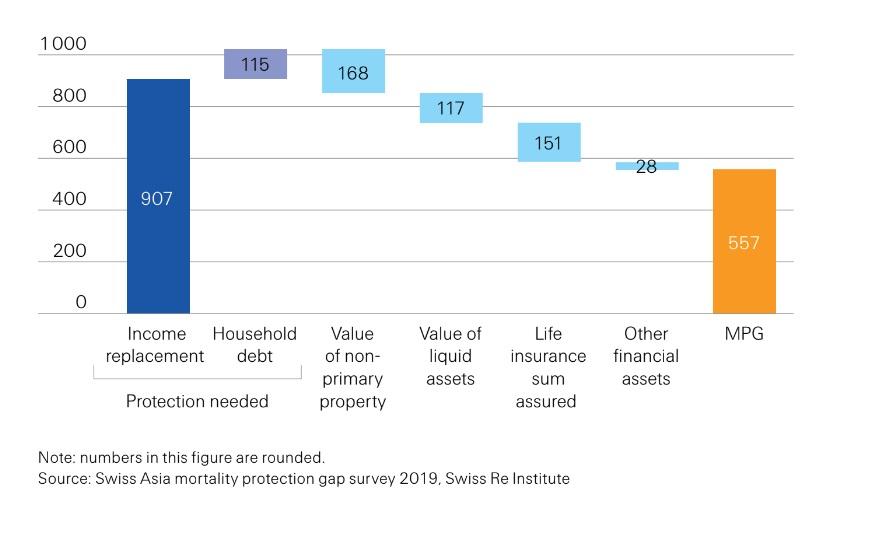

Despite a large majority indicating high awareness of life insurance, households in Singapore have the highest average mortality protection gap per household across Asia-Pacific, with more than half of protection needs not covered, a report by reinsurer company Swiss Re found.

A total of 92% of survey respondents revealed that they are aware of life insurance. However, life insurance only covers 14.8% of mortality protection needed in 2019.

In total, mortality protection gap per Singaporean household stood at $887,489 (US$644,725) in 2019.

Perceived high cost is the main barrier to purchase, cited by 47% of our survey respondents.

Many Singaporeans also have a negative perception of insurance, with 23% citing this is a reason why they refrain from purchasing a policy, higher than other markets in Asia. Singapore consumers pay equal attention to other factors when considering buying life insurance: sum assured (51%), return of premiums when policy matures (45%), ease of making claims (41%), and coverage period (41%), the report found.

Due to these barriers, life insurance ownership in Singapore is lower than in Hong Kong and Japan.

One way to bridge the protection gap is to focus on under-protected segments such as young professionals and female sole breadwinners, according to Swiss Re.

“Our survey results show young professionals are more likely to consider life insurance at key life milestones such as marriage,” the report stated.

“For female sole breadwinners, agents and friends’ recommendations play an influential role,” it added.

Offering more affordable bite-sized, modular products as well as linking life sales to consumers’ lifestyles and commitments may be another way to increase life insurance ownership in the island. These include tying them up with mortgages or bundling family elements with life cover, for example.

“[Mortgages] have a large effect on protection needs, which insurers can leverage. Singapore has one of the highest property ownership rates in Asia. Insurers could differentiate based on ease of application or offer modifiable coverage as mortgage protection need declines,” said Swiss Re.

“Insurers should also bundle family protection elements with life cover as consumers get married, have children or when one of their parents begins to require increased care.”

Insurers are also called to take advantage of locals’ tech-savviness.

“Respondents to our survey said they are open to doing research, completing insurance applications and making payments digitally. As consumers are more familiar with insurance products than in other Asian markets, they are also more likely to be receptive to digital experimentation in the insurance buying experience,” the report expounded.

Advertise

Advertise