Chart of the Day: Singapore banks brace for waves of deteriorating asset quality

Banks' risk exposures are at their worst since 2009.

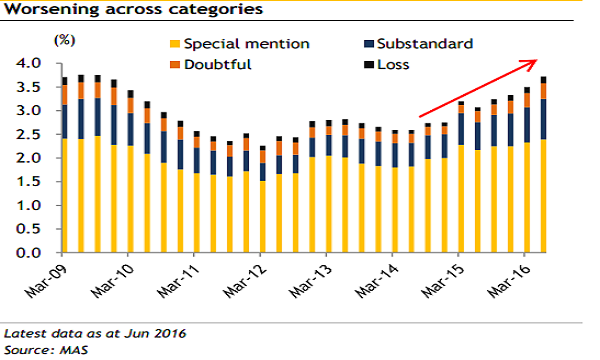

August's banking system data remained uninspiring as system loans growth continued to contract, reflecting a subdued economy. Furthermore, As at Jun16, asset quality deteriorated as banks’ special mention and classified exposures worsen to levels not seen since 2009, said Maybank Kim Eng.

As the chart above shows, exposures at all categories have worsened. The substandard category is now at its highest level since disclosure started in 2009.

"Our bigger concern is Singapore banks will face slowing top-line growth and deteriorating asset quality," said Maybank KimEng.

Maybank KimEng's base case is for a gradual increase in NPLs for Singapore banks through FY16-18E. "Key risk to our estimate will be large corporate defaults or black swans," it noted.

Official statistics show that despite a 1% MoM improvement in Aug, system loans contracted 5.2% YoY, reflecting weak business and consumer sentiment.

Loans have declined for eight consecutive months, the longest streak of contraction since 2005.

Loans to businesses -7.5% YoY, with declines led by manufacturing (-6.4% YoY), general commerce (-17.7% YoY) and others (-27.7% YoY) sectors.

Consumer loans were lacklustre, mainly weighed down by housing loans (+3.5% YoY) from headwinds in the domestic property market.

According to Maybank KimEng, with fewer lending opportunities, banks are likely to compromise on loan pricing to compete for market share.

"We estimate less than 2% loan growth in FY16 for Singapore banks. Stronger deposit growth, asset quality deteriorated system deposits grew 2.2% YoY due to DBU (domestic banking unit) deposits (+5.9% YoY)," said MayBank KimEng.

Maybank KimEng explained that the recent increase in DBU fixed deposits could be partly attributed to the competitive rates that banks offered. Competition for deposits, it said, may intensify as banks need to meet higher LCR (liquidity coverage ratio) requirements.

"System LDR eased to 98.4% but still suggests a tight liquidity system, said Maybank KimEng.

Advertise

Advertise