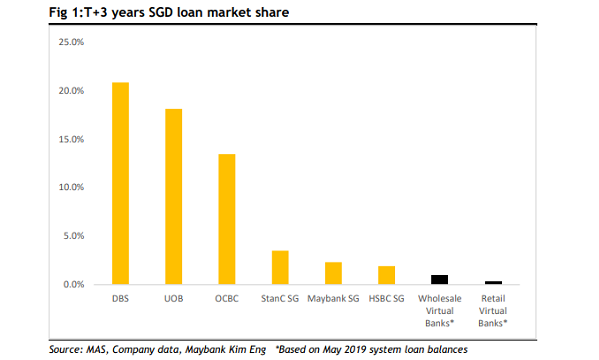

Chart of the Day: Virtual banks may only account for less than 1% of Singapore loan market by 2022

The retail upstarts may account for 0.3% market share and wholesale challengers will take 0.9% of the market.

Virtual banks are unlikely to cause a significant shake-up to Singapore's dominant lenders with expectations that the five new licensees are set to snap up less than 1% of the SGD loan market by 2022, according to projections from Maybank Kim Eng.

"[E]ven with ultra-aggressive growth, the two challenger retail banks will account for just 0.3% of SGD loan market share while the three wholesale challengers will take 0.9% market share," Thilan Wickramasinghe, analyst at Maybank Kim Eng said in a report.

DBS is expected to emerge as the clear leader of the SGD loan market, accounting for 20% of the market followed by UOB and OCBC. Standard Chartered, Maybank and HSBC are tipped to account for less than 5%.

Also read: Virtual banks pose threat to Singapore's small and foreign lenders

Even if the digital newcomers post return of assets that are double the figures by incumbent banks given their lower operating costs, the overall virtual banking sector can only potentially dilute just 1.3% of incumbent bank earnings by 2021, according to Maybank. In an earlier report, Moody's estimated that digital banks can only command around 2% of domestic banking assets once they become fully operational.

"Digital banks will find it hard to upend status quo," Wickramasinghe said. "Singapore incumbents are already deploying sophisticated solutions similar to what digital banks in other markets offer."

The regulator earlier announced that it will be issuing up to two full digital banking licenses and three wholesale as part of an effort to liberalise the financial services sector that has long been dominated by the Big Three. Reuters reported that Grab is said to be exploring the possibility of entering the digital-banking space.

In a similar move, Hong Kong earlier issued a total of eight virtual banking licenses to firms including entities backed by tech giants like Tencent and Ant Financial.

Advertise

Advertise