Financial Services

7 in 10 SMEs plan to do more business internationally

7 in 10 SMEs plan to do more business internationally

Given this, more firms have been using apps for cross-border payments.

41% of Singaporean business leaders skeptical about their financial data: survey

Manual processes and human error are mainly to blame.

Study shows 1 in 2 financially savvy Singaporeans own crypto, bullish on its future

High risk and volatility are some of the top concerns deterring non-crypto users.

Will MAS keep its policy parameters unchanged for the whole year?

Experts estimate the S$NEER to be at +1.5% appreciation gradient, with +/- 2.0% band.

Singapore’s monetary policy likely to normalise in April: analyst

Singapore’s central bank may reduce the S$NEER slope by 50 basis points

MAS keeps policy unchanged in January MPS

The central bank said the current policy settings remain "appropriate."

DBS, OCBC to log higher net profits, muted loan growth for Q4: analyst

DBS may hike its quarterly dividend by 6 cents to return surplus capital.

Gov’t establishes new sustainable finance body

The association will improve standards, solutions, and skills in the finance sector.

IFPAS, Kaplan launch new certification programme for financial practitioners

The programme will take six to 12 months to complete.

Gov’t extends application for the Simplified Insolvency Programme until 2026

The programme helps MSCs facing financial difficulties.

ACRA revokes registrations of LW Business Consultancy and its director

The firm reportedly committed anti-money laundering breaches.

What are the most confusing financial terms for Singaporeans?

"Equity" ranks first with 270,000 average monthly searches.

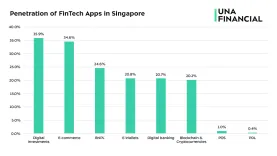

What is the most popular fintech app in Singapore?

The top app is used by 35.9% of Singaporeans.

Singapore retains lead in Asia for crypto readiness

Globally, Singapore ranked 5th.

MAS awards Moomoo Singapore an MPI license

The license will allow the firm to offer new services to Singapore investors.

SPF, MAS to work with PRC on the unfreezing of monies transferred via remittances

As of 15 December 2023, SPF has received over 670 reports of remittances being frozen.

Aspire’s new vibrant workplace, a tribute to Singaporean roots

The fintech player named its meeting rooms after iconic MRT stations like Orchard, Marina Bay, and more.

Advertise

Advertise

Commentary

Singapore’s family offices: Time to professionalise or risk falling behind

Liquidity crucial to stock market reform