Financial Services

B2B bad debt level increases to 9%

B2B bad debt level increases to 9%

Agri-food had the highest average of write-offs across industries in Singapore.

Woman faces charges for unlicensed fund management business

If convicted, she will be fined up to $150,000 or detained for up to three years.

UOB prices $400m perpetual capital securities

It will be issued under a $41.5b (US$30b) global medium term note programme.

Mergers, IPOs plunge in first half of 2022

The value of the seven IPOs in Singapore so far is 90% lower than last year's.

Alternative lending startup Helicap bags $6.94m in new funding round

The round was led by Temasek-backed Tikehau Capital.

SC-STS welcomes LCH’s clearing extension for OTC SORA derivatives

The central clearing was extended from 21 years to 31 years.

MAS unveils AI tool to help financial institutions curb greenwashing

The AI utility is part of the National Artificial Intelligence Programme in Finance.

SGX RegCo, ACRA form advisory committee on sustainability reporting

The committee comprises 13 members.

MAS conducts cyber crisis management exercise with French central bank

The exercise evaluated the effectiveness of cyber crisis coordination.

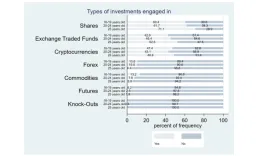

Chart of the Day: Which is the common type of investment for young people

Young people mostly invest their money in shares.

Singapore’s $35b green bond sale lifts sustainable financing capabilities

The taxonomy initiative will reduce the cases of greenwashing.

2 new DWBs offer ‘incremental income’ to SGX-listed Credit Bureau

Digital wholesale banking businesses raise the count of bureau members to 36.

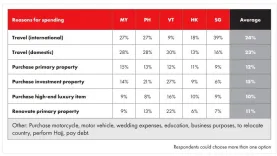

Chart of the day: Singaporeans to spend more on travel in the next 12 months

Most Singaporeans want to fly abroad more than just go somewhere local.

Gov't establishes framework to push for high quality green bonds

A committee will oversee the Singapore Green Bond Framework.

OCBC US$750m Tier 2 notes priced at 4.602%

Proceeds will be used for general corporate purposes.

Yangzijiang Financial Holding puts up $200m share buy-back programme

It will increase shareholders’ value and improve return on equity.

SG-based Capital C Corporation bags $74min fresh funds

The firm was founded by brothers Jeames Cheow and JJohn Cheow in 2011.

Advertise

Advertise

Commentary

Singapore’s family offices: Time to professionalise or risk falling behind

Liquidity crucial to stock market reform