F&B sector set to grow as mass-market segment sizzles

Whilst high-end restaurants close up shop, mass-market is tipped to grow at a 2.1% CAGR over the next five years.

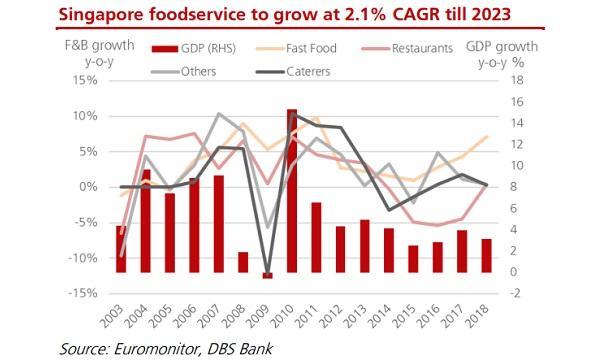

Singapore's F&B sector is projected to grow at a 2.1% compound annual growth rate (CAGR) over the next five years amidst robust expansion in the mass market segment, according to a report from DBS.

Defined as a segment with a per-head spend of $20 or less, the mass-market sector is estimated to be worth $6.2b or 75% of the overall F&B market. Companies in the mass-market segment have demonstrated healthy growth through acquisitions such as NTUC Foodfare’s acquisition of Kopitiam and BreadTalk’s planned acquisition of Food Junction.

"Mass-market F&B has shown robust growth and resilience to GDP cycles, offering both quality and value to consumers, with the next 5-year CAGR estimated at over 2.5% for each mass market subsegment (cafes, kiosks and limited service restaurants)," analyst Alfie Yeo said in a report, adding that shifting consumer behaviours are driving trends towards eating-out, convenience, quick-service formats, and faster payment/checkout modes including cashless and online transactions.

In comparison, some higher-end restaurants have been closing up shop as business environment weakens. Three- and two-Michelin-starred restaurants like Robuchon Restaurant and Restaurant Andre had to relinquish their stars due to low profitability. Moreover, full-service restaurants expanded by a much slower 0.8% CAGR from 2008-2018 and is expected to grow at an even slower 0.4% over the next five years.

“[O]perators in the slowing higher-end full-service restaurants segment might need to operate with caution," said Yeo. "The recent slow GDP growth rate projections for Singapore could also fuel more switching from high-end to mass-market segment as compared to previous years."

Singapore’s foodservice sector is currently worth about $8.3b and has seen a 2.4% CAGR over the ten-year period 2008-2018, led by cafés/bars, limited service restaurants, and street stalls/kiosks.

Operators in the mass-market segment would also be able to extract higher productivity than high-end F&B by implementing more self-service initiatives more easily than high-end full-service formats, as foreign worker dependency ratio is being tightened.

In addition, these companies are capable of morphing into multi-format, multicuisine, and multi-brand F&B companies which will allow them to introduce foreign brands, whilst exporting their own brands overseas for regional growth, as well as to utilise technology to deliver operational efficiencies.

“The composition of malls has gradually shifted in favour of more non-discretionary (particularly mass-market F&B) and activity-based concepts that are harder to replicate online. This will likely remain a key strategy for landlords going forward, who are starting to see value in incorporating more mass-market F&B tenants into the mix,” Yeo said.

Advertise

Advertise