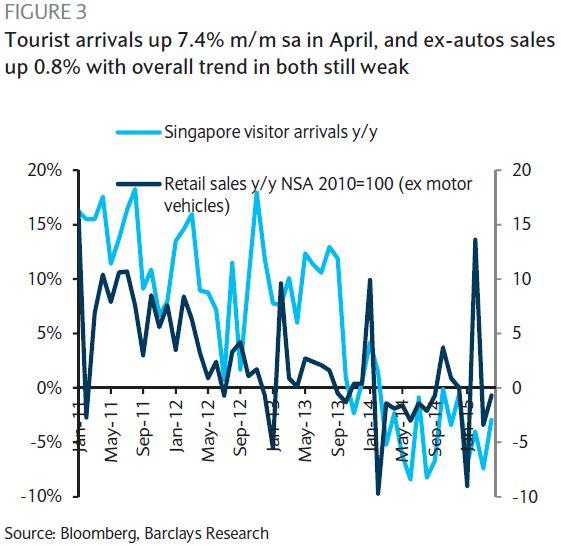

Chart of the Day: Check out the deep plunge in tourist arrivals since 2013

As retail sales joined the ride downhill.

Barclays recently reported that it hosted Desmond Sim, Head of CBRE Research for Singapore and Southeast

Asia, in a luncheon meeting with investors.

Sim revealed that CBRE expects the government could start easing the residential measures as early as Dec 2015, office rents to soften on the plentiful prime office space in 2016 and the retail space sector to remain weak on structural challenges.

Here's more from Barclays:

According to CBRE, in 2014, 2.6mn sqft of retail space was completed, with most of it coming out from non-traditional retail locations such as Kallang Wave (Sportshub), PayaLebar Square, and One KM, at a time when demand is waning.

Vacancies have moved up as a result; Suburban to 5.2% and Orchard to 5.6% as of end 2014. Japanese brands like Franc Franc, Lowrys Farm, Fancl have come and gone over the past few years.

With growing eCommerce, omnichannel retail has emerged, where retailers go both online and offline. This means retailers do not need as many physical stores. SGD strength has made online purchases directly from Europe more attractive, while regional retail centers have blossomed e.g. Bangkok with its new mega malls all within a few mass transit stops; Mapletree also opened its new Vivocity in HCMC.

Tourism has taken a hit as Chinese tourists who previously traveled to Singapore as part of the “Golden Triangle” – Malaysia, Singapore and Thailand, declined after a series of unfortunate flight incidents. In addition, international brands such as H&M which were previously unavailable are now available in more locations, so there are fewer reasons to buy in Singapore.

Mall operators need to innovate and create traffic by increasing activity-based shops, e.g. spas, learning, F&Bs, but these tenants do not pay as much. They have to also bring in new, first-to-market brands to excite shoppers.

There may be some relief in supply as URA has stopped granting approvals and cutting allowable retail space.

CBRE expects retail rents to decline by 2% this year, though selected suburban malls with catchment residential demand should still be stable. It estimates that South Beach retail is more than 60% filled with very strong F&B tenants. Capitol Piazza has done very well bringing in a lot of first-to-market overseas F&B concepts.

Advertise

Advertise