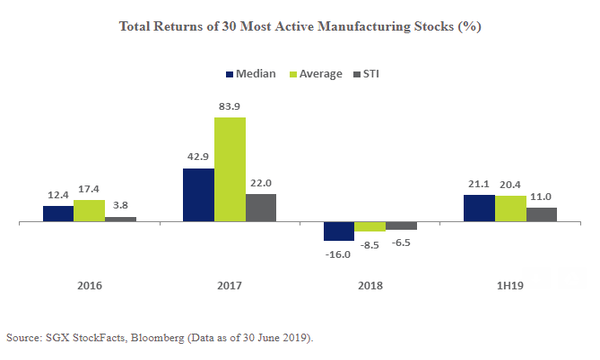

Chart of the Day: Top 30 manufacturing stocks hit 20.4% average return in H1

Their combined net institutional inflows amounted to $264m.

This chart from the Singapore Exchange (SGX) shows that the top 30 most actively traded non-food manufacturers hit an average return of 20.4% in H1, outperforming STI gains of 11% for the same period.

SGX noted that the total returns of the 30 stocks in H1 were consistent than recent years, with a median 21% total return and combined net institutional inflows of $264m.

In 2018, the manufacturing stocks witnessed average returns of -8.5%, a stark contrast compared to the 83.9% average returns in 2017.

Amongst the stocks, YZJ Shipbuilding, Venture Corporation, and ST Engineering placed 7th, 11th, and 19th in H1 overall turnover ranking whilst their total returns for H1 hit 27%, 20%, and 22%, respectively.

“When the STI generated positive gains, the manufacturing stocks outpaced those benchmark gains and when the STI generated declines, the manufacturing stocks tended to exacerbate the benchmark’s decline,” SGX explained.

Advertise

Advertise