Delistings drag on Singapore's recovering IPO market

There are about 14 companies undergoing privatisation in 2019.

Singapore’s IPO market will remain unsteady in the years ahead as the number of delistings in SGX continue to outnumber the volume of new listings, according to a Fitch Solutions report. This further builds on the IPO scene’s underwhelming performance in 2018.

As a result, the number of listed companies in the nation has declined for each full-year period since 2013 onwards through to the end of 2018, with expectations that the delisting trend will only gain further momentum.

“[W]e forecast the continuation of a worrying trend which is seeing a steady flow of public-to-private delisting deals on the Singapore Stock Exchange (SGX). This is bad news for both the IPO arena and local ECM more broadly,” the report stated.

Separately, DBS Group Holdings stated that there are about 14 companies undergoing privatisation this year. Bloomberg research points to aircraft maintenance firm SIA Engineering, event producer and promoter Unusual, engineering plastics producer Fu Yu Corporation, high-tech capital and consumer equipment service provider Frencken Group and luxury watch retailer The Hour Glass as potential delisting candidates before year-end.

“Meanwhile, we point to the climate of low valuations as largely to blame: the STI is trading at one-year forward price-to-book ratio of 1.05 compared with 1.34 for the MSCI Asean Index, according to Bloomberg data accurate to August 12 2019. SGX data also show that equity flows are heading in a similar direction too, with institutional investors net selling -$981.7b during the month of July,” the report noted.

As an attempt to make the number of delistings grow slower, SGX has revised its rules on the delisting process to make it “less favourable, rather than stop them completely.”

Under the new laws, companies looking to voluntary delist will now have to pay a higher premium to get a deal completed; receive the approval of 75% of shares held by independent shareholders; and gain the approval of the appointed independent financial advisor (IFA) that they are both 'reasonable' and 'fair'.

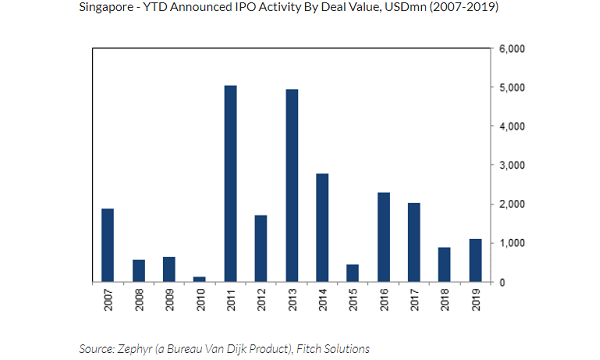

Singapore’s IPO market is starting to rebound from its 2018 performance as IPO deals in YTD climbed to $1.54b (US$1.11b) from nine IPO deals, surpassing share sales of $1.27b (US$920m) raised from 24 floats in the previous year, the report cited data from Zephyr.

“Whilst the STI’s 2019 performance appears impressive at first glance, zooming out from the headline numbers suggests that the rebound has merely come from a low base to return to more historically average levels. In our view, the same can be said for new listing activity in the SGX,” Fitch Solutions explained.

Fitch Solutions noted that 2018 was an exceptionally slow year for floats and saw just four deals which raised over $138.5m (US$100m). The largest deal was the proposed US$245.4m float of an unknown stake in power distribution holding company Summit Power International. The deal failed to reach the market as it was postponed having cited a lack of demand from equity capital market (ECM) investors for non-real estate investment trust (REIT) listings on the SGX.

In H1, the two notable deals involved ARA US Hospitality Trust and Eagle Hospitality REIT. ARA US Hospitality Trust is the first listed US hospitality trust on the local bourse, which priced its stapled securities at $1.19 (US$0.88) apiece, whilst Eagle Hospitality REIT’s 580.56 million securities were offered at $1.06 (US$0.78) apiece. In addition, Prime US Real Estate Investment Trust’s IPO deal also went above $138.5m (US$100m) with a $408.54m (US$294.98m) float.

As all three deals are comprised of REITS and Summit Power is a non-REIT, Fitch noted that ECM investors are starting to lose appetite with non-REIT deals.

“Such deals suggest that the SGX remains a go-to fundraising source for the Singaporean REIT sector, which continues to ranks as the biggest in Asia (excluding Japan). We note that there are 42 REITs and property trusts active in Singapore at the time of writing, with a combined market capitalisation of $90b representing a substantial portion of the real estate market,” Fitch solutions continued.

Furthermore, ECM investors continue to receive support from the government as well, citing MAS’ decision way back 2015 when they decided to cut 60% leverage limit for REITs that retain a credit rating, which would subsequently be subject to the same limit as other REITs.

MAS added that it would raise the leverage limit for all REITs to 45% of the total assets, up from 35%. Furthermore, it increased the limit on property developments by 15-25% of a REIT's assets to allow for more operational flexibility.

Advertise

Advertise