M&A activity drops 18.5% to US$54.3b YTD

Deal size shrank from US$129.1m to US$113.4m.

Singapore’s total merger & acquisition (M&A) activity fell 18.5% to US$54.3b so far this year compared to the first nine months of 2017, however, it is still beyond historical levels, Thomson Reuters revealed.

According to a report, the average M&A deal size for disclosed deals fell to US$113.4m compared to US$129.1m. During the third quarter of 2018, Singapore’s deal activity amounted to US$12.9b, a 53.9% decline from the second quarter of 2018 and down 66.1% in value from the third quarter of 2017.

Total cross-border deal activity amounted to US$27.6b, marking a 41% crash over the same period last year (US$46.8b). Singapore’s inbound M&A activity fell 68.1% in deal value whilst outbound M&A activity increased by 13.7%.

Domestic M&A activity also greatly fell by 39.1% to US$6b despite an increase in the number of domestic transactions by 1.2%. Real Estate (58.0 %), Industrials (13.2%), and Financials (10.6%) sectors accounted for a combined 81.8% market share of Singapore’s domestic M&A activity.

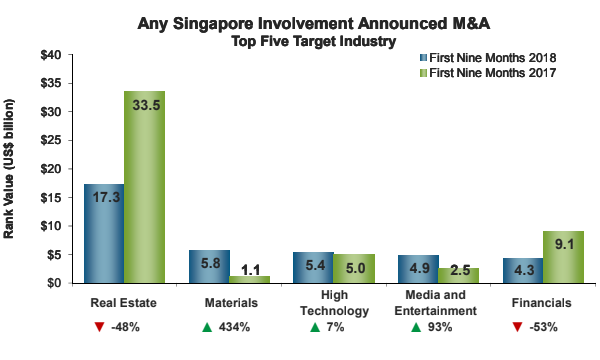

Completed M&A deals involving Singapore amounted to US$50.4b so far this year, a 13.1% decline in value compared to the first nine months of 2017 (US$58b). The Real Estate sector took the lead and accounted for 32% of the market share worth US$17.3b, down 48.3% in terms of deal value, from the first nine months of 2017.

M&A activity targeting the Materials sector totalled US$5.8b, a significant increase compared to the same period last year (US$1.1b) and saw the highest first nine months period since 2008 (US$17.0b).

“This was driven by Singaporean state-owned Temasek Holdings (Pte) Ltd’s pending agreement to raise its stake to 4%, in Bayer AG, a German-based manufacturer of organic chemicals, worth US$3.7b, in a privately negotiated transaction. The deal is currently the biggest transaction involving Singapore so far this year,” Thomson Reuters added.

High Technology and Media & Entertainment followed behind with 9.9% and 9.0% market share, respectively, as deal value grew compared to last year.

Meanwhile, buyside financial sponsor M&A activity in Singapore saw US$2.3b worth of deals so far this year, almost unchanged in terms of deal value. The number of private equity-backed deals, however, grew 14.3% from a year ago.

Foreign acquisitions targeting Singapore-based companies fell by 68.1% to a four-year low of US$9.9b. The High Technology sector accounted for 25.5% of Singapore’s inbound M&A activity and totalled US$2.5b, despite a 32.6% decrease in value from a year ago.

“Alibaba Group Holding Ltd of China planned to raise its interest in Lazada South East Asia Pte Ltd, a Singapore-based online retailer, for a total US$2b, in a privately negotiated transaction,” Thomson Reuters noted. The deal pushed China as the most active acquiror in terms of deal value, capturing 40.7% of Singapore’s inbound activity.

The United States followed behind with 22.9% market share, whilst Japan represented 13.3% market share and saw the most number of inbound acquisitions in Singapore.

On the upside, Singapore outbound M&A jumped 13.7% to US$17.7b and saw the highest first nine months period since 2014. Real Estate industry is the most targeted sector thus far, capturing 35.2% of Singapore’s outbound activity, with US$6.2b worth of deals, down 14.2% in value from a year ago.

Germany is the most targeted nation for Singaporean overseas deals so far this year in terms of value, accounting for 23.2% market share, driven by Temasek’s US$3.7b additional stake acquisition in Bayer AG.

Singapore’s overseas acquisitions in the US reached US$3.5b so far this year, down 23.2% in value from a year ago. India and China followed with 14.0% and 8.1% market share, respectively.

Advertise

Advertise