Markets & Investing

Bahrain wants to bridge Singapore startups to US$1.5t Gulf market

Bahrain wants to bridge Singapore startups to US$1.5t Gulf market

Startups can easily set up shop with a new fast-track process for registration.

Daily Briefing: ST Telemedia leads $54.41m funding round in US-based analytics firm; HDB to set up 6,000 digital screens in housing estates

And employment-seeking platform GrabJobs expands to Indonesia.

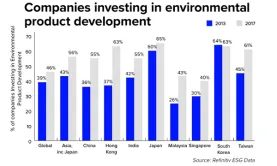

Singapore corporates lag in environmental sustainability

Only 40% of companies develop environmentally-conscious products.

Daily Briefing: Cost blamed for slow take-up of electric cars; Analytics startup Milieu Insight bags $3.27m pre-Series A funding

And fintech startup InstaReM rebrands to Nium.

SBR Hottest Startups Panel Briefing 2019 draws over 130 delegates

Topics on the agenda include the road to unicorn status and learning from startup failures.

Perennial unit sold 45% stake in YIS to Yanlord Commercial for $202.68m

The proceeds will be used for corporate and general working capital.

Utico and Hyflux agree to cap advisor fees at $40m

The UAE company also threatens to cut its investment to $200m if a deal has not sealed in time.

1 in 3 senior financial officers worried about global recession risks

27% flagged the impact of trade tariffs on their businesses.

Big Idea Ventures' Christian Cadeo preps for SBR's Hottest Startups Panel Briefing

The managing partner will share how entrepreneurs can navigate the food tech space.

CapitaLand Treasury issues $500m perpetual notes

Listing of the notes is expected to take place on 18 October.

SGX to launch $1.5b multicurrency debt issuance programme

The net proceeds will be utilised to finance investments of the firms and its subsidiaries.

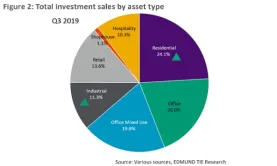

Chart of the Day: Check out which asset type got the most investments in Q3

The residential market made up almost a quarter of total investments.

CARRO's co-founder Kelvin Chng to grace SBR's Hottest Startups Panel Briefing 2019

He will join the panel to discuss what it takes for startups to expand and thrive overseas.

SGX sticks to smaller deals as blockbuster bourse mergers fall through

The bourse is looking at potential fintech acquisitions.

PE fund Quadria Capital secures ING financing tied to sustainability performance

The $89.08m three-year revolving facility will peg its interest rate to ESG targets.

AccelerAsia's Joeri Gianotten shares insights at SBR's Hottest Startups Panel Briefing 2019

Whilst most VCs merely act as advisors or consultants, the company does deals on behalf of its clients.

Daily Briefing: Q&M Dental Group sells 36% stake in China-based associate for $49m; NEU at Novena condo opens for preview

And UK-based startup Upgrade Pack expands to Singapore.

Advertise

Advertise

Commentary

Singapore’s family offices: Time to professionalise or risk falling behind

Liquidity crucial to stock market reform