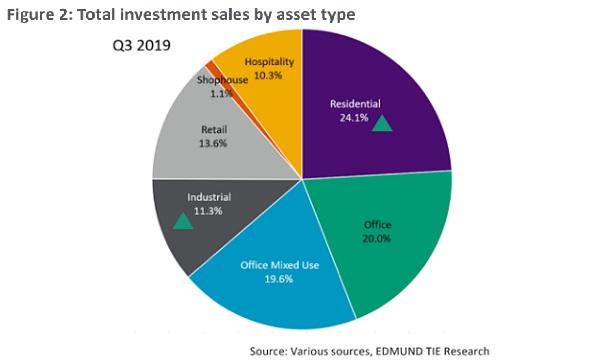

Chart of the Day: Check out which asset type got the most investments in Q3

The residential market made up almost a quarter of total investments.

This chart from Edmund Tie and Co. reveals the breakdown of Singapore-bound investments in Q3, with the residential market (24.1%) making up almost a quarter of total investment sales during the period.

Office investment sales, which made up 47.1% of the value in Q2, fell to only 20% during the quarter. Office mixed-use assets rounded up the top three with 19.6% of total sales in Q3 after not being present in Q3

On a quarterly basis, total investment sales jumped 33.8% tp $8b in Q3. The private sector accounted for 76.5% of the value, although public investment sales value almost doubled as a result of more residential sites sold under the Government Land Sales (GLS) programme.

Advertise

Advertise