Markets & Investing

Moomoo, Nasdaq renew global strategic partnership

The two parties enhance their six-year collaboration with the announcement of the new global partnership.

Apple CEO Tim Cook to meet with Singapore leaders: report

His trip follows Apple's US$350m campus expansion announcement in Ang Mo Kio.

CICT NPI rises 6.3% YoY to $293.7M in 1Q24

Gross rental income growth and lower operating expenses drove the uptick.

Singapore tops SEA fintech funding with US$372M

The city accounts for 70% of SEA's total funds raised.

Keppel DC REIT divests Sydney data centre for $152.1m

The agreed value is 148.6% higher than the original investment.

Higher financing costs impact Keppel Pacific OAK US REIT's income

The REIT's income available for distribution fell to US$11.9m in 1Q24.

Enterprise SG, Temasek, and BE launch funding for SEA climate tech

Participating researchers will receive an initial USD$500,000 grant.

Staple bags US$4m in pre-series A funding round

The company will use the funds for its expansion.

Three investment strategies to boost Singapore’s green lead

In 2023, Singapore made US$913m worth of private green investments.

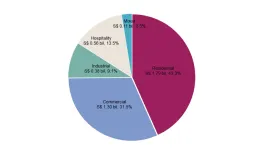

Residential sector dominates 1Q24 investment with $1.79B

The sector's investment sales, however, dropped 48.5% QoQ.

Safe haven assets and equities draw Singapore investors' interest

Investors over 40 prefer Singapore stocks.

Elite REIT expands into UK living sector assets

The REIT will also change its name in due course as part of its expansion.

Mapletree Investments acquires 8,192 student beds in UK, Germany

The $1.7b deal will boost Mapletree's UK portfolio bed count to over 17,000.

Temasek opens Paris office to expand Europe footprint

With the addition of the Paris location, Temasek now has 13 offices in nine countries.

Sabana REIT aims for manager internalisation by 3Q24

The REIT has made progress in its Order 32 application.

Frasers Property Limited braces for profit dip, points to UK property woes

It expects to record fair value losses and impairment in 1H24.

Advertise

Advertise

Commentary

Singapore’s family offices: Time to professionalise or risk falling behind

Liquidity crucial to stock market reform