News

ST Engineering's profit up 16.9% to $577.95m in FY2019

ST Engineering's profit up 16.9% to $577.95m in FY2019

All of its business segments posted increases in net profit.

DBS converts $758m bank guarantee facility into green facility

Wind turbine maker Siemens Gamesa will issue green guarantees under the facility.

CapitaLand to release one-month security deposit for retailers

It aims to help ease tenants’ cash flows amidst COVID-19.

Daily Briefing: Grab reverses plan to cease driver incentives; Kimly acquires food outlets for $55.8m

And Bukit Sembawang Estates sold 64% of units of Luxus Hills Contemporary Collection.

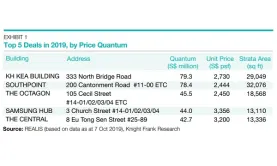

Chart of the Day: Here are the priciest strata office deals in 2019

The most expensive deal is a 29,049 sqft building sold for $2,730 psf.

Daily Markets Briefing: STI down 0.55%

ComfortDelGro saw the sharpest decline amongst top active stocks with a 1.46% contraction.The Straits Times Index ended 17.65 or 0.55% lower at 3,181.03.The top active stocks were DBS, which inched down 0.08%, Singtel, which fell 0.96%, UOB, which slid 0.73%, ComfortDelGro, which dropped 1.46%, and OCBC Bank with a 0.18% slip.The FTSE Mid Cap dipped 0.65% whilst the FTSE Small Cap edged down 0.94%.

StarHub's profits slid 10.9% to $178.6m in 2019

Lower revenues were reported for the Mobile, Pay TV, and broadband lines.

Wilmar International's profits grew 15% to $1.78b in 2019

Growth was driven by higher profits from the Oils and Oilseeds segments.

Sembmarine ex-consultant charged in Brazil for money laundering, corruption

He was connected to a consultant engaged by its subsidiaries on contracts with Sete Brasil.

DBS Group prices $1.4b issue at 3.3%

The deal is said to bear the lowest coupon for any AT1 USD deal in the world.

Sembcorp Industries' profits dropped 29% to $247m in 2019

The contraction in profits was due to losses incurred by the marine and energy business.

Government balance to remain in “healthy surplus” in 2020

The city’s public finances remain sound despite a higher budget deficit.

ST Engineering unit secures 30 aircraft engines

The deal includes about $358m of fixed rate notes offered in three tranches.

Deliveroo's orders grew 20% amidst COVID-19 outbreak

In 2019, orders on the platform surged 50% YoY.

Changi Airport to give tenants 50% rental rebates

The rebates will be available to over 500 retail and F&B stores.

Prime US REIT to raise $168.04m from private placement

This will fund its acquisition in California.

UOB's net profits up 8% to $4.32b in FY2019

A final dividend of $0.55 and a special dividend of $0.20 was as recommended.

Advertise

Advertise

Commentary

Why Singapore businesses must focus on outvaluing, not just upskilling

Singapore’s family offices: Time to professionalise or risk falling behind

Liquidity crucial to stock market reform