News

SIA Group's passenger load factor rose 2.6 ppt to 87.6% in December

SIA Group's passenger load factor rose 2.6 ppt to 87.6% in December

This was led by Singapore Airlines' PLF as it climbed 2 ppt to a record-high of 87.5%.

SPH prices 10-year US$500m notes at 3.2%

It will be used for financing its general working capital.

Frasers Commercial Trust NPI grew 26% to $26.7m in Q1

Higher rental income from China Square Central and Alexandra Technopark drove its growth.

SGX RegCo proposes to require listed firms to have a Singapore-registered auditor

The regulator aims to strengthen auditor accountability and investor confidence.

CapitaLand wins tender to operate Bugis Village and Bugis Street

The award has an initial tenancy term of three years.

MAS, ACRA launches scheme to help fund managers cover investment funds

Fund managers can now incorporate or re-domicile VCCs online.

Hyflux applies for another debt moratorium extension

The hearing is scheduled on 29 January 2020.

Daily Markets Briefing: STI down 0.41%

OCBC Bank saw the sharpest decline amongst top active stocks with a 1.08% decline.

Daily Briefing: Local listings snub Singapore for Hong Kong; Impact investor IIX closes $12m Women's Livelihood Bond 2

And Bank of Singapore hires Nomura’s wealth management head.

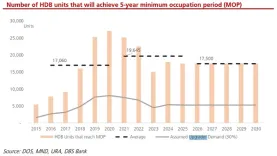

Chart of the Day: Almost 20,000 HDB units per annum to hit MOP in 2020 onwards

Stable prices in the resale market may drive upgraders to buy a bigger home.

New private home sales plunged 53.1% in December to 538 units: URA

Developers held back launches as buyers stayed quiet during the holidays.

MIT buys 10 data centres in North America for $750.1m

Its portfolio now has a total of 27 data centres in the said continent.

Exits loom for new telco players amidst 5G roll-out

TPG is tipped to record losses.

Singapore businesses remain hesitant to outsource recruitment

Many organisations only outsource for specific projects or urgent hiring.

Condo rents down 0.9% in December

CCR and OCR condo rents declined 1.7% and 1.1%, respectively.

Singtel's Bharti Airtel closes qualified institutions placement at $8.43 per share

The fundraising was made ahead of paying $6.62b dues to the Indian government.

Venture Corp to have a stable 2020 as Phase 1 deal commences: analyst

The firm has been receiving enquiries regarding new projects outside China. Venture Corporation’s profits will likely benefit from the signing of the Phase One deal, where the US looks to cancel tariffs that were due to come into effect in December 2019, according to a note by CGS CIMB.

Advertise

Advertise

Commentary

Singapore’s family offices: Time to professionalise or risk falling behind

Liquidity crucial to stock market reform