News

SGX teams up with China Construction Bank to attract more Chinese listings

SGX teams up with China Construction Bank to attract more Chinese listings

Both direct and secondary listings are on target. The Singapore Exchange (SGX) has inked a memorandum of understanding (MOU) with China Construction Bank (CCB) to promote domestic capital markets to Chinese companies. Under the MOU, SGX and CCB will collaborate to bring Chinese companies to list in Singapore, especially through SGX’s Direct Listing Framework. CCB is among the issue managers accredited by SGX to assist companies in raising capital on the exchange. As part of the MOU, it will also advise its SGX-listed clients looking to tap the secondary market for further fund-raising. The MOU will also encourage Chinese companies to issue offshore Renminbi bonds , undertake mergers & acquisitions, establish cross-border asset management services and other capital market activities in Singapore. In addition, CCB will explore derivatives trading, bond trading and other business activities in Singapore. There are currently 120 Chinese companies and 103 RMB bonds listed on

Inflation books 17th straight month of contraction with 1% fall in March

On back of hefty decline in transport costs.

Over 4 in 10 Singaporeans are disgruntled with residential market: survey

Expensive prices are a top concern.

Singapore Tourism Development Fund to get $700m boost from 2016 to 2020

It's to aid the local tourism sector's transformation.

Bumitama Agri’s FFB yield plummets 24% to 3.1t/ha

Last year’s El Nino is still hurting output.

Marco Polo gains stay of proceedings in legal battle with Sembcorp Marine unit

Arbitration proceedings have already commenced.

SGREIT’s earnings jump 7% YoY to $41.6m in Q3

Thanks to Myer Centre Adelaide’s contributions.

Raffles Med’s Q1 profits inch up 3.7% to $15.5m

On back of increased staff expenses.

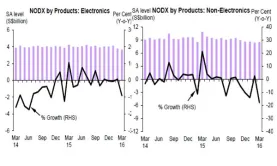

Chart of the Day: No light at the end of the tunnel for Singapore’s NODX

External demand is showing no sign of a rebound.

Frasers Centrepoint Trust’s profits inch up 0.4% to $33.7m in Q2

Thanks to lower tariffs, write-back of property tax provision.

Daily Markets Briefing: STI down 0.69%

Prepare for a pullback today.

Daily Briefing: Developers get creative to sell units; Resale flat prices slip 0.1% in Q1

And private home prices down 0.7% in Q1.

Office rents feared to slip by as much as 15% this year

Demand will stay muted as tenants downsize.

Top entrepreneurs, investors gather at SBR's 20 hottest startups of 2016 panel briefing

It featured four sessions with 20 panellists.

GuocoLand's net profit crashed 77% to $11.3m in Q3

Earnings dropped sharply as big-ticket sales vanished.

Rigbuilders' share prices slip as Sete Brasil goes belly-up

Keppel sustained heavier losses.

Retail rents continue to slump as massive space supply comes onstream

Rents dropped by 1.9% in Q1.

Advertise

Advertise

Commentary

Why Singapore businesses must focus on outvaluing, not just upskilling

Singapore’s family offices: Time to professionalise or risk falling behind

Liquidity crucial to stock market reform