News

Pay your credit card bills with OCBC's 'pay any card' service

Pay your credit card bills with OCBC's 'pay any card' service

Visa, MasterCard, AmEx or Diners Club - name it; you can pay your credit card bills via OCBC Internet and Mobile Banking.

Apparel service provider Ocean Sky replies to SGX queries

The substantial increase in the company's share price got SGX concerned.

Motorists could soon use their ATM cards to pay car park

Find out how car park operators could also benefit from this first time ever scheme in Singapore.

Genting to face stricter reporting rules as junket licenses review continues

To whom much is given, much is required.

February inflation slightly eases to 4.6%

Food prices hit a seasonally expected dip but accomodation costs keep shooting up.

Will Singapore become a new high roller haven?

That's the goal of newly licensed International Market Agents as they woo foreign gamblers to Singapore casinos.

Singapore imposes two new workplace standards

Make sure yours meets the stricter safety and health guidelines for manual handling and machine lockouts.

IBM raises Jurong to become Singapore’s next business capital

How much could a US$50-million grant do?

Singapore welcomes 14.5 million tourists in 2012

And pockets S$24 billion returns - bring it on!

Junket approval to alleviate RWS' bad debts: CIMB

CIMB says Resorts World Sentosa is off to a good start as competitor MBS has yet to endorse any junket operators.

2011 was the year of “hacktivists”

Did it screw last year’s Singaporean election?

Two junket licenses approved for Resorts World Sentosa, 12 others rejected

The management of Genting Singapore is probably surprised by joy.

Inflation probably unchanged at 4.8% in February

Rising political tension in the Middle East a major threat going forward, says DBS.

Should Singapore investors love the proposed covered bond rules?

Quality maintenance, check; Legal protection, not covered.

CapitaLand completed acquisition of Shanghai property

Capitaland announced additional 50% interest in Innov Tower, Shanghai.

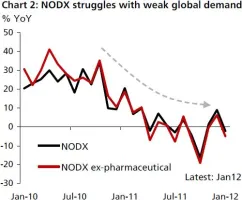

Chart of the Day: NODX struggles with weak global demand

Singapore’s overall export performance has been badly affected.

Singapore ranks most productive in Asia Pacific

But in terms of what, you might ask.

Advertise

Advertise

Commentary

Singapore’s family offices: Time to professionalise or risk falling behind

Liquidity crucial to stock market reform