News

Singtel and ComfortDelGro tie up for in-app taxi booking feature

Singtel and ComfortDelGro tie up for in-app taxi booking feature

The partnership will extend Dash users’ ability to pay for their cab fares via QR code.

COE prices closed mostly lower in latest bidding exercise

The prices of category E vehicles saw the highest decline of $4,998 to $42,002.

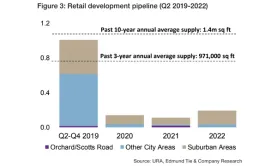

Chart of the Day: 1.5 million sqft of retail property supply to come online by 2022

Over half of the upcoming retail development will be completed in 2019.

Daily Briefing: Government cuts private housing stock amidst oversupply; HSBC pumps up Singapore SME banking team

And SP Group and Gardens by the Bay unveiled a project to convert waste to by-products.

Public transport payment via Visa goes live

The project will be one of Visa’s largest implementations for contactless acceptance for transit globally at 30,000 acceptance points.

Retail property sales fell 2.3% in Q1: study

The sales decline in optical goods & books and food retailers dragged it down.

HDB resale prices down 1.2% in May

It also reflected an 18.3% YoY jump from 1,754 units resold.

Commemorative $20 bill unveiled for Singapore's bicentennial

It can be availed in nine major retail banks.

Six more firms join SGX watchlist

All failed to have a volume-weighted average price of at least $0.20 per share.

ComfortDelGro invests $136.6m in three tech startups

These startups are SWAT, Haulio and Israel-based Foretellix.

Singtel unveils moveable unmanned 24/7 pop-up store

A roving live bot provides personalised phone and plan recommendations.

Daily Markets Briefing: STI up 0.61%

UOB inched up 1.74%.

Daily Briefing: Temasek and Tencent invest $47.8m in London-based fintech; GIC raises stake in Julius Baer

And Credit Counselling Singapore has launched programme to help cash-strapped SMEs.

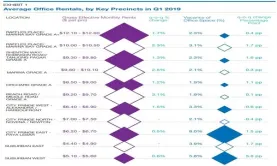

Chart of the Day: Office rents rose 1.5% in Q1

Rents in Beach Road/Middle Road saw the highest increase at 3.1%.

Online hiring for telecom and BPO roles up 39% in April

However, Singapore was outpaced by Malaysia with a 43% growth in online recruitment.

Singapore GDP to lag ASEAN peers in 2019: ICAEW

Economic growth is expected to decline to 1.9% from 3.1% in 2018.

Malaysia hospital developments could uplift IHH earnings

It is also beginning to reap better contributions from Fortis.

Advertise

Advertise

Commentary

Singapore’s family offices: Time to professionalise or risk falling behind

Liquidity crucial to stock market reform