Luxury homes buck residential sales decline in May

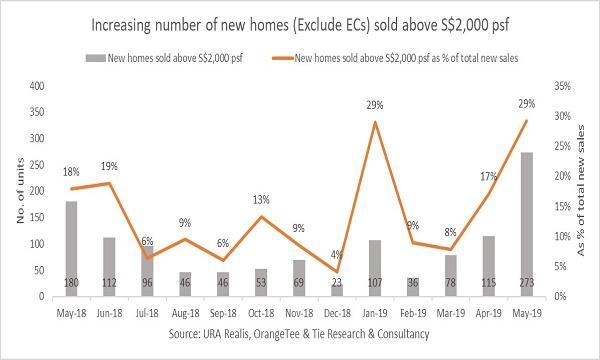

Sales have come to a relative standstill, with the exception of homes priced above $2,000 psf.

Whilst new private home sales rebounded strongly in May MoM as more projects were launched prior to the June holidays, new home sales dipped 15.2% YoY with no executive condominiums (EC) sold during the month, the Urban Redevelopment Authority’s (URA) developers’ sales survey revealed.

A total of 1,394 new private homes were released for sale in May, of which 6% were in the core central region (CCR), 51.3% in the rest of central region (RCR) and 42.8% in outside the central region (OCR). CBRE noted that including May’s numbers, a total of 3,525 units have been sold YTD, out of 4,827 units launched YTD in 2019.

New project launches included Amber Park, Riviere, Parc Komo, The Gazania, The Hyde, Juniper Hill, The Lilium, Meyerhouse and Olloi.

Despite the muted take-up, Singapore’s property market was buoyed by demand for homes above $2,000 psf, according to Christine Sun, OrangeTee & Tie’s head of research and consultancy.

Also read: Residential unit sales up 0.1% in Q1 as luxury home transactions drive gains

URA Realis data shows that almost 30%) of new home sales or 273 units were transacted above $2,000 psf.

“New homes transacted at this price sky-rocketed 661% from 36 units in February to 273 units in May this year, which is also the highest number inked since December 2013 (295 units),” Sun highlighted. The top-selling projects for May were Amber Park with 155 units sold at a median price of $2,475 psf, Parc Komo that moved 79 units at a median price of $1,497 psf and The Woodleigh Residences that sold 74 units at a median price of $1,823 psf.

“Of the 273 transactions, 193 units were from RCR which is a historical high number of new homes sold above $2,000 psf for the market segment,” she added.

Also read: 17% of the world's ultra-rich want new homes in Singapore

In another solid showing for the luxury segment, ultra-high-net-worth investors remained upbeat as 48 new homes were also sold for $3m and above, which is the highest number inked since May 2018 with 56 units.

URA noted that another 28th floor (527 sqm) unit at Boulevard 88 was also transacted last month for $28m or $4,936 psf, surpassing the previous record of $4,927 psf for another unit at the same project inked in March 2019.

“However, this month saw an even higher priced 28th floor unit (562 sqm) at Boulevard 88 being transacted for a record smashing $5,125 psf, which is the sixth most expensive condo by psf sold on record (since 1995). By price quantum, this unit was transacted at $31m, which is the fifth most expensive condo sold on record (since 1995),” Sun said.

She explained that the strong demand for premium homes could be attributed to liquidity in the market from the latest collective sales cycle, that may continue to sustain the property sector and keep demand fairly stable in the near term. Further, Singapore’s property market is highly regarded as one of the world’s safest haven for capital appreciation and preservation in the long run, especially with its strong currency and transparent housing regulations.

Meanwhile, Colliers Research expects that takeup could ease slightly in June during the school holidays where sales activity typically slows, before picking up again in July ahead of the Hungry Ghost month which will begin in mid-August.

For the whole of 2019, Colliers Research estimates that 9,000 new residential units (excluding ECs) could be sold, up slightly from the 8,795 units in 2018.

The firm also forecasts takeup to remain relatively healthy as more projects could potentially be launched. These include prime projects Haus on Handy (188 units), Jervois Prive (45 units); city fringe projects Avenue South Residence (1,074 units), One Pearl Bank (774 units), and Amber Sea (132 units), as well as suburban project Piermont Grand Executive Condominium (820 units).

“We estimate that overall private home prices could stabilise in H2 2019, and rise by 1% for the full year 2019. Supporting factors that could hold up prices in the coming quarters include: halt in interest rate increases, continued benign economic growth, and en bloc beneficiaries buying replacement homes,” Tricia Song, head of research for Singapore at Colliers International, noted.

Advertise

Advertise