Photo from URA

Photo from URA

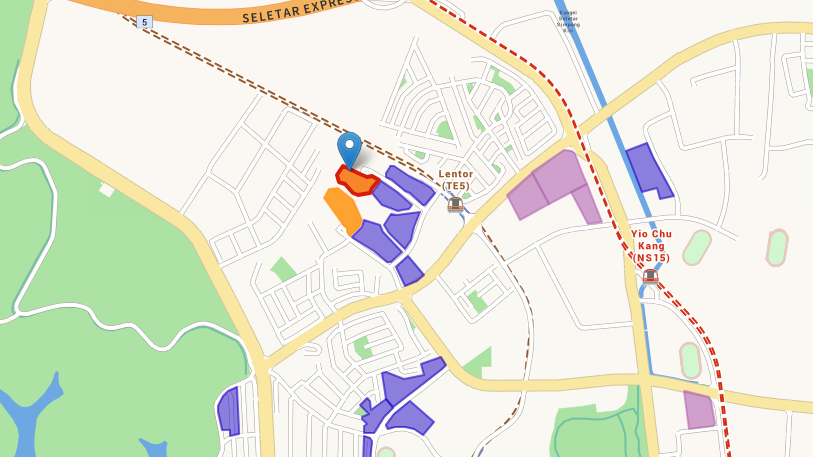

Why Champion Way site drew more bids than Lentor Central

The land parcels received six and two bids, respectively.

Bids in the recent Government Land Sales (GLS) tender involving Champion Way and Lentor Central sites reflect heightened caution amongst developers, said real estate experts.

The muted bidding response to Lentor Central, in particular, shows that developers have “restrained in their bids due to the uncertain economic conditions, continued high costs, and harmonisation of GFA rules,” according to Huttons.

Wong Siew Ying, head of Research and Content at PropNex Realty, said the Champion Way site drew more bids than the Lentor Central land parcel likely due to developers wanting to mitigate risks.

"Lentor area has more supply of new private residential units," Wong underscored.

OrangeTee & Tie's Deputy CEO Justin Quek shared a similar sentiment, saying developers may have held back in the Lentor area as "more land could be released next year."

"The government has already announced more new land parcels to be released or old buildings/sites slated for redevelopment," Quek added.

CBRE also underscored that Lentor Central is the sixth Lentor site to be awarded.

Compared with the Lento Grandes tender, CBRE said the response to the Lento Central site is "slightly warmer" given its proximity to the Lentor MRT station and amenities at Lentor Modern mixed development.

Leonard Tay, head of research at Knight Frank Singapore, also believes that the Lentor area having "too many condominium projects being developed within a few years of each other" could have pushed away developers.

"With a total possible seven sites, including the five sites that were sold previously, the Lentor Central site that closed today and one more site on the present Government Land Sales Reserve list, in the area, this could potentially bring about some 3,500 new units, translating to almost 11,000 new residents at the average Singaporean household size of 3.09," Tay said.

“This might constitute too many homes, and people, in an area of less than 0.5 sq km, to be developed within a span of three to six years assuming all seven sites are sold,” Tay added.

Meanwhile, EDMUND TIE’s head of research and consulting, Lam Chern Woon, observed that Hong Leong and GuocoLand have shown a “ strong desire to fend off competition and maintain their pricing power” in the Lentor area.

“The top bid of S$982 psf ppr was submitted by Intrepid Investments, a subsidiary of Hong Leong Holdings, GuocoLand and CSC Land Group. Given that the Lentor Gardens site was awarded to the sole bid by GuocoLand and Intrepid Investments in April this year for S$985 psf ppr, market players will likely exercise restraint by submitting lower bids for the Lentor Central site as the supply pressure mounts,” Woon said.

“Hong Leong and GuocoLand have won four sites in the Lentor precinct, either on a single or joint basis,” Woon added.

Advertise

Advertise